You Focus on Your Future. We’ll Focus on Your Finances.TM

Fee-only, comprehensive wealth management for all generations.

Bedel Blog

The Corporate Transparency Act

The CTA was enacted in 2021 to combat criminal activity, such as money laundering, tax fraud, and...

Tax Planning for the Soon-to-Be Retiree

Retirees can maximize their retirement wealth by implementing tax-efficient strategies such as...

Ask Bedel

Welcome to #AskBedel, a weekly personal-wealth Q&A where you can ask financial planning and...

Riding the (Weight Loss) Wave: Balancing FOMO with Prudent Risk Management

Eli Lilly's future holds immense potential, but a balanced perspective is crucial. While...

GenNeXt Blog

Instant Gratification? Not So Fast

It’s easy to opt for instant gratification when it comes to financial decisions. It feels good to...

The Lost Years: The Untold Truth About Your 30s

What people fail to talk about is how this phase of life is expensive and can easily throw a...

Important 529 Plan Changes

Any Indiana resident contributing to a CollegeChoice 529 plan is eligible for a refundable state...

Student Loan Repayment: Back Like Never Before

It’s not abnormal for borrowers to feel they are in a different spot financially since March of...

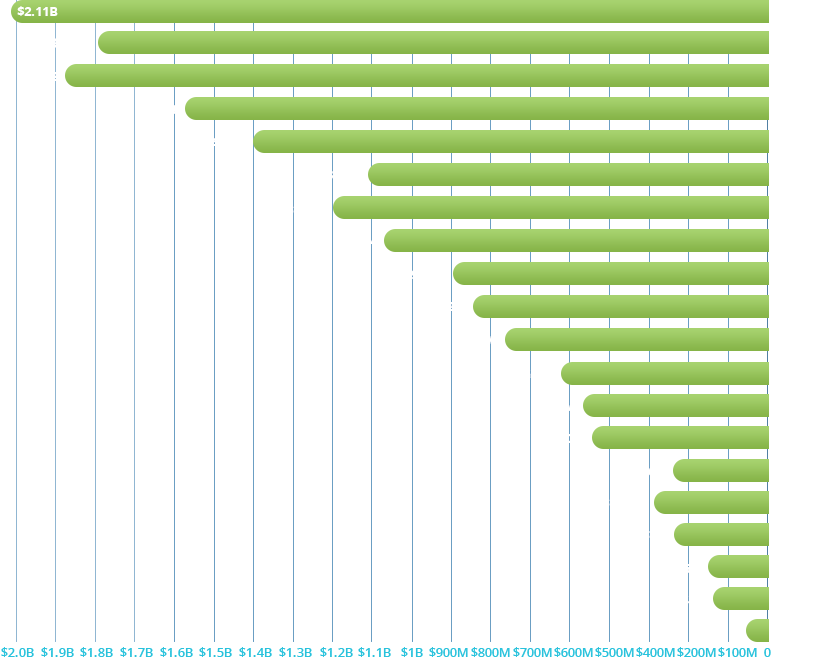

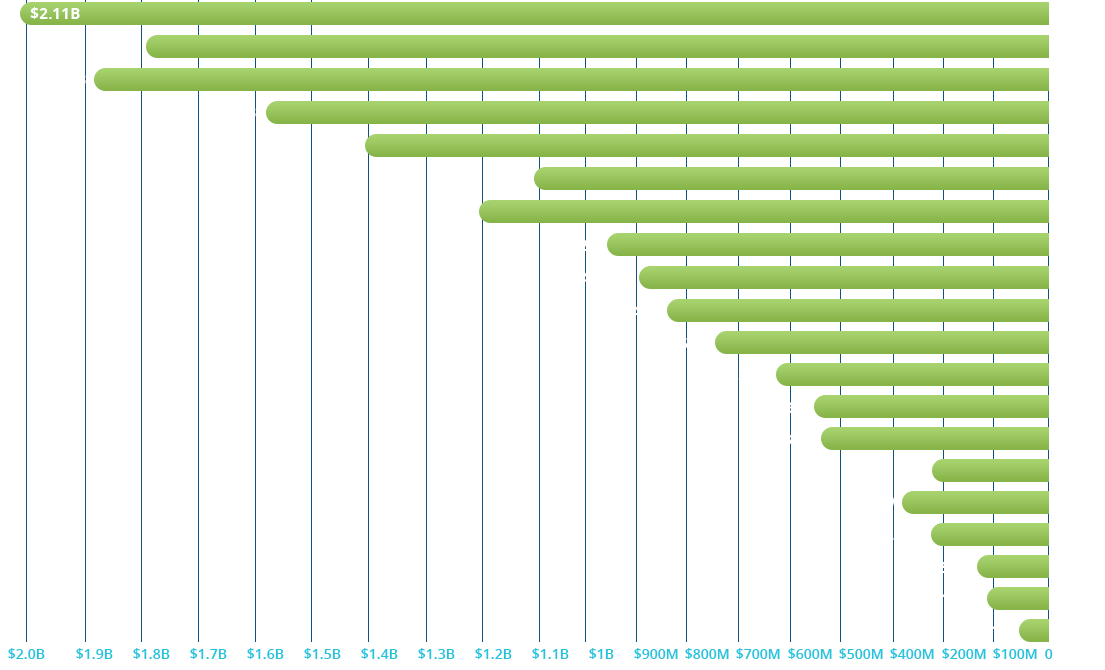

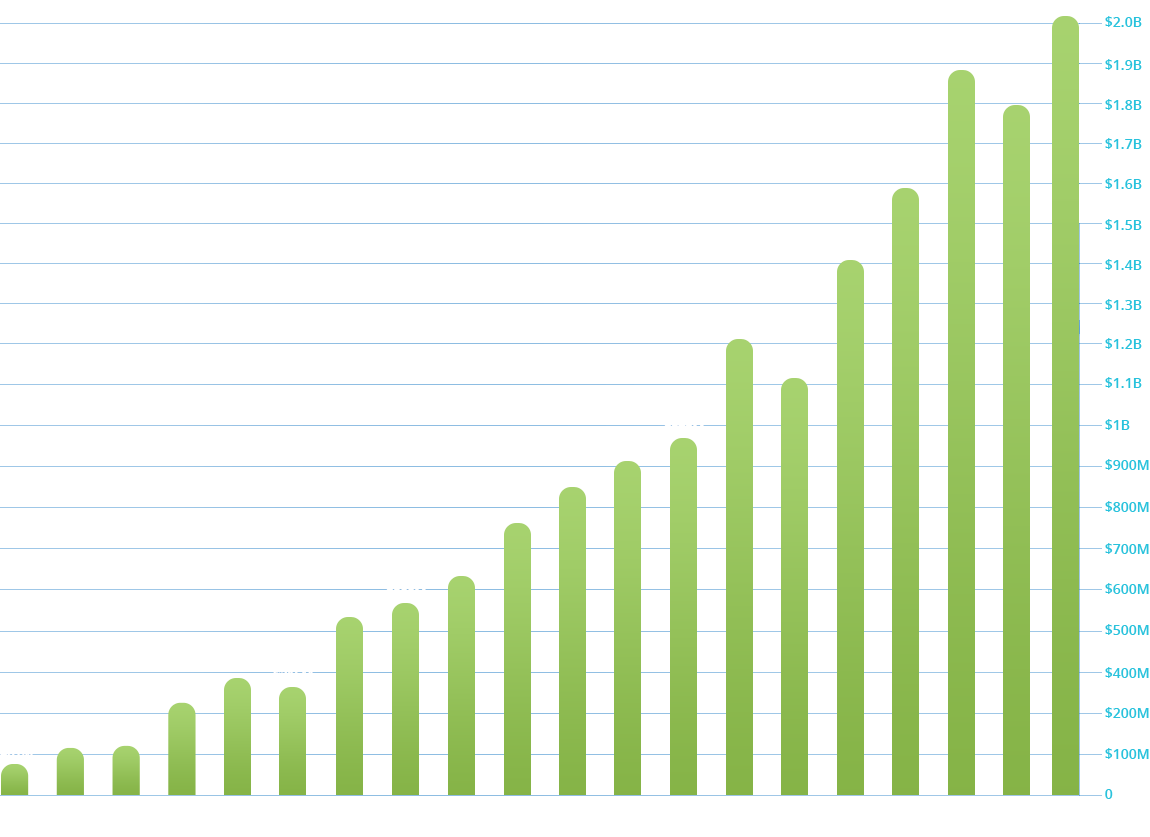

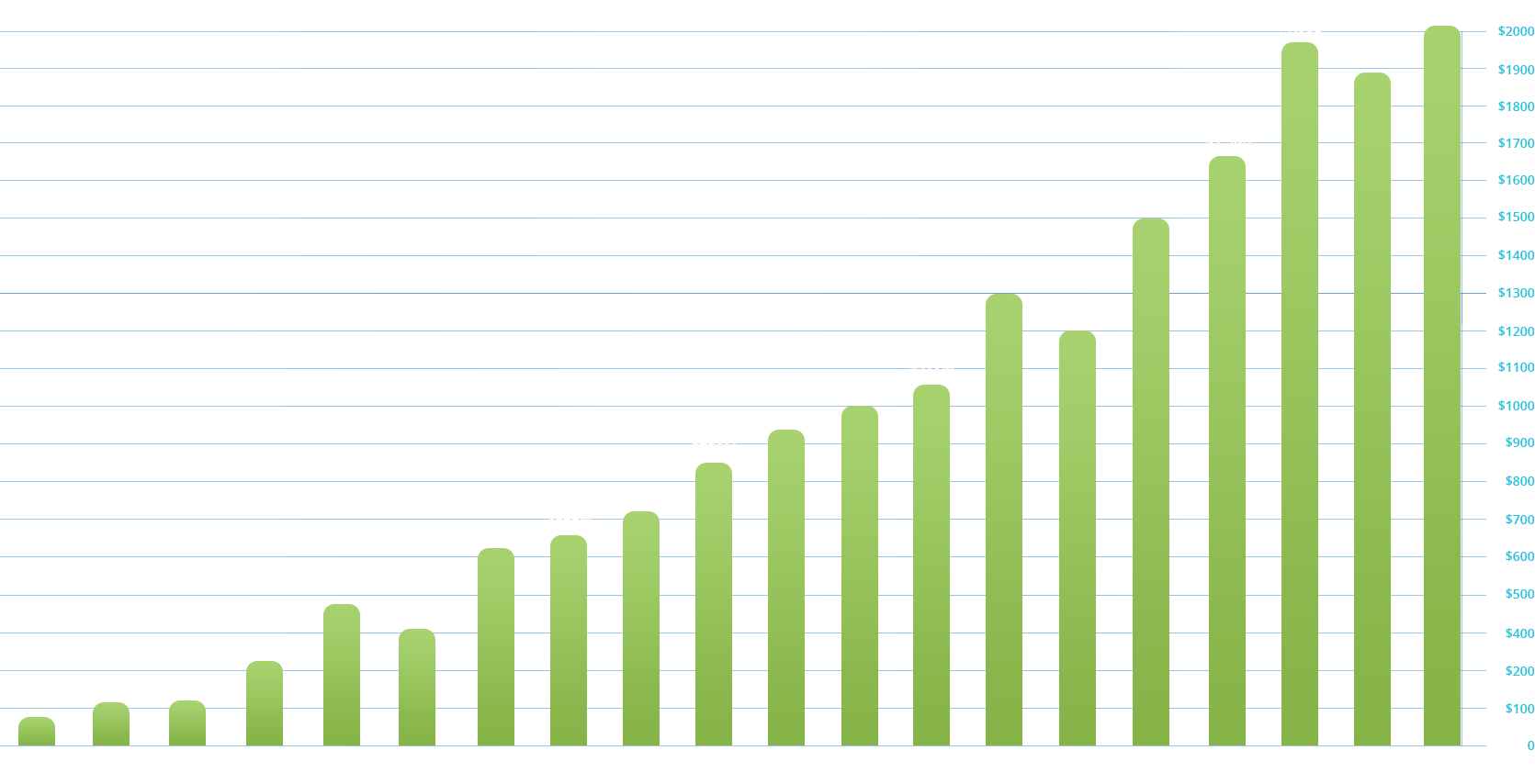

BEDEL BAROMETER

Last updated April 2024

BEDEL FINANCIAL GROWTH BY CLIENT INVESTMENT ASSETS

(DISCRETIONARY ASSETS UNDER MANAGEMENT)

Values as of December 31st of each year