Comprehensive wealth management. Committed to your success.

Your financial success comes first. From the time Bedel Financial was founded in 1989, we knew the key to success was to put your interests first. As a Fiduciary, we’ve held ourselves to the highest standard of care since the firm was established. Our client-first approach is built on transparency and trust—no commissions, no products to sell. Just confidence and peace of mind, so you can focus on the moments.

Let us help you!

Bedel Financial is a comprehensive, fee-only wealth management firm, dedicated to helping you achieve financial security. We understand that you may not have the time, energy or expertise to manage it all yourself. You don’t have to. Watch the video to learn about our process.

"We are truly becoming the dedicated champion of our clients’ aspirations and dreams.”

- Elaine E. Bedel, CFP®

WHAT MAKES US DIFFERENT

Stability, Strength & Security

Established in 1989, we actively manage over $1.8B in investable assets with a team of 26 industry professionals supporting our clients every day. Bedel Financial has the stability, strength and security to meet your unique financial needs. Our Process is designed to help relieve the stress of navigating your finances alone.

Independent

As a fee-only financial planning and investment firm, our commission-free compensation comes exclusively from our clients. Our independence allows for unbiased advice and provides us complete flexibility in matching your portfolio needs with the appropriate investment vehicles.

Commitment to Excellence

Our advisors hold the premiere designations in our industry - CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Financial Analysts (CFA) or Certified Investment Management Analyst (CIMA®) -reflecting their dedication to the field of comprehensive wealth management. Meet the Team

Investment Committee for Thorough Analysis

In 2009, the firm formed the External Investment Committee, a select group of individuals in the investment industry and academia. Our investment management team meets with the committee members quarterly to discuss the economic and investment environment, as well as potential investment strategies for our clients. Final investment decisions are approved by the Bedel Financial Internal Investment Committee.

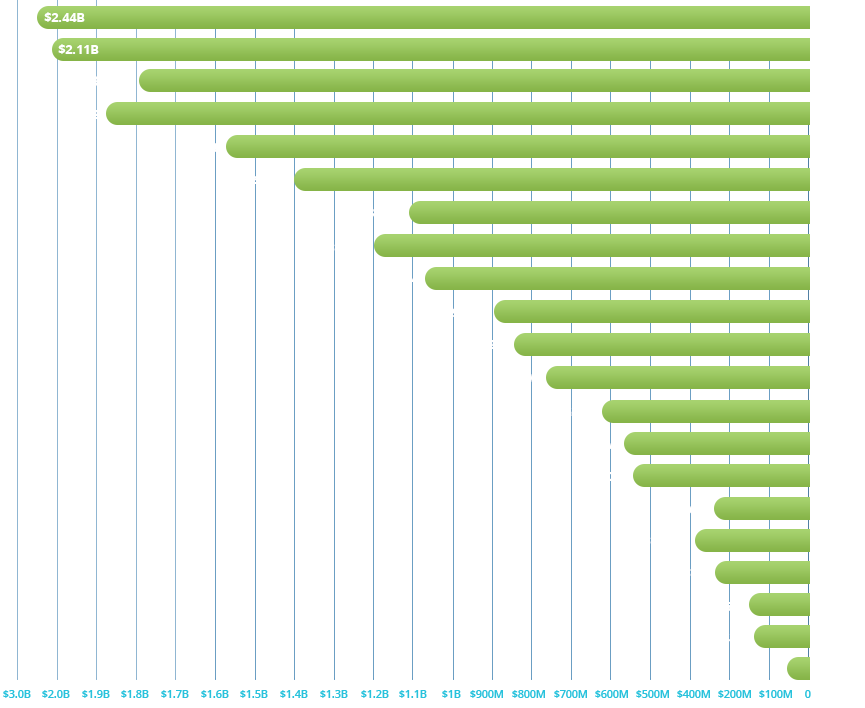

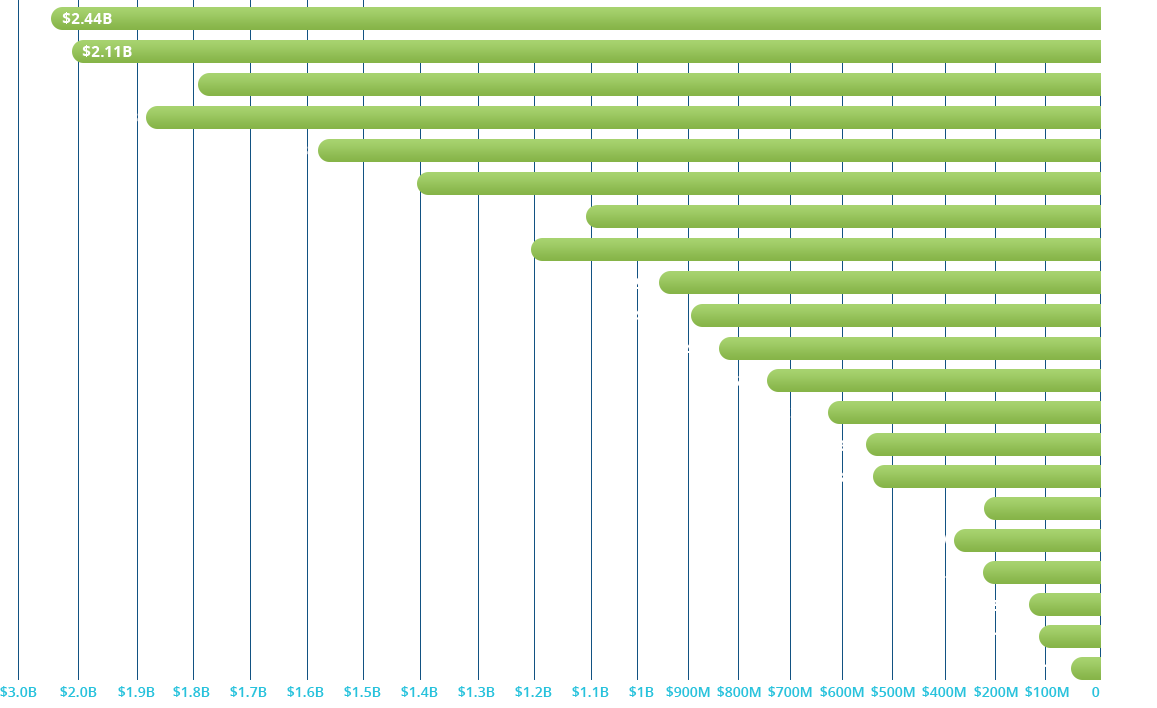

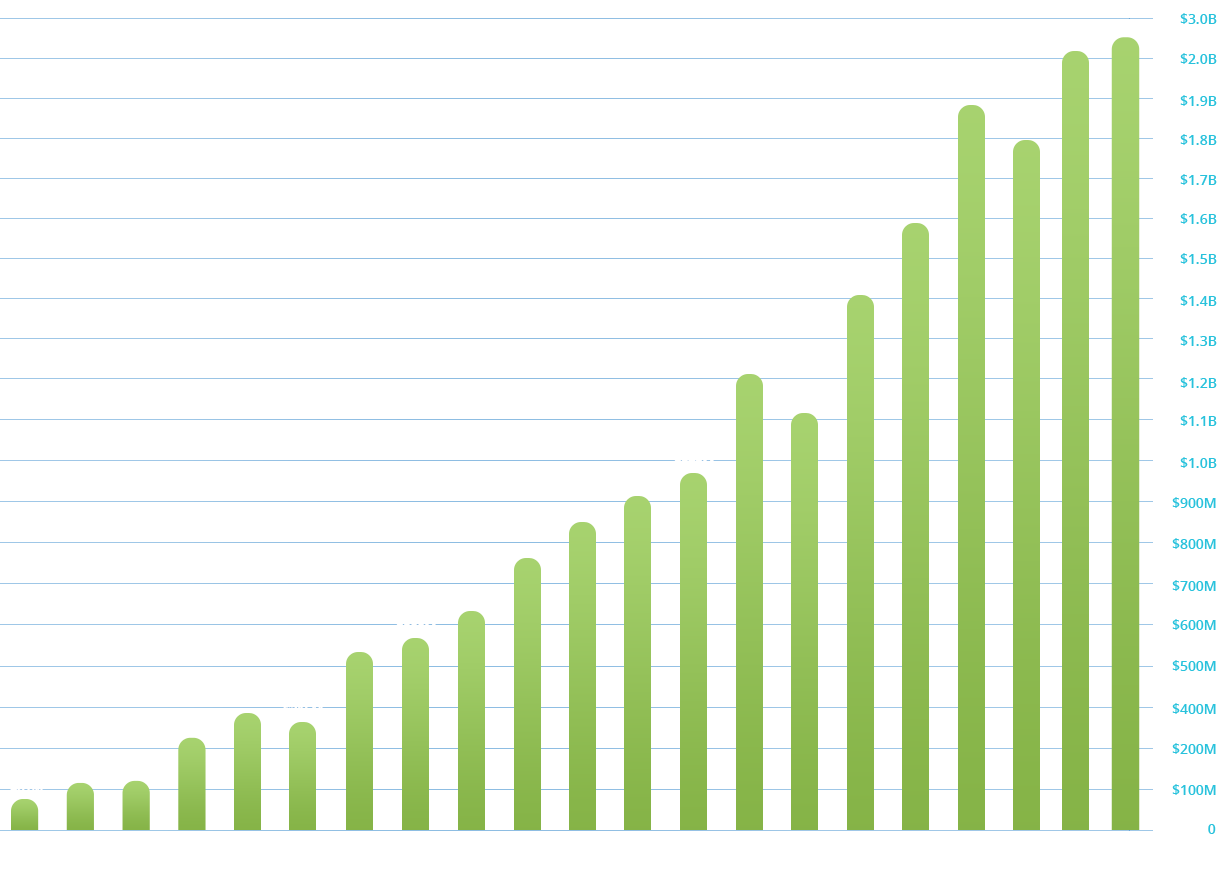

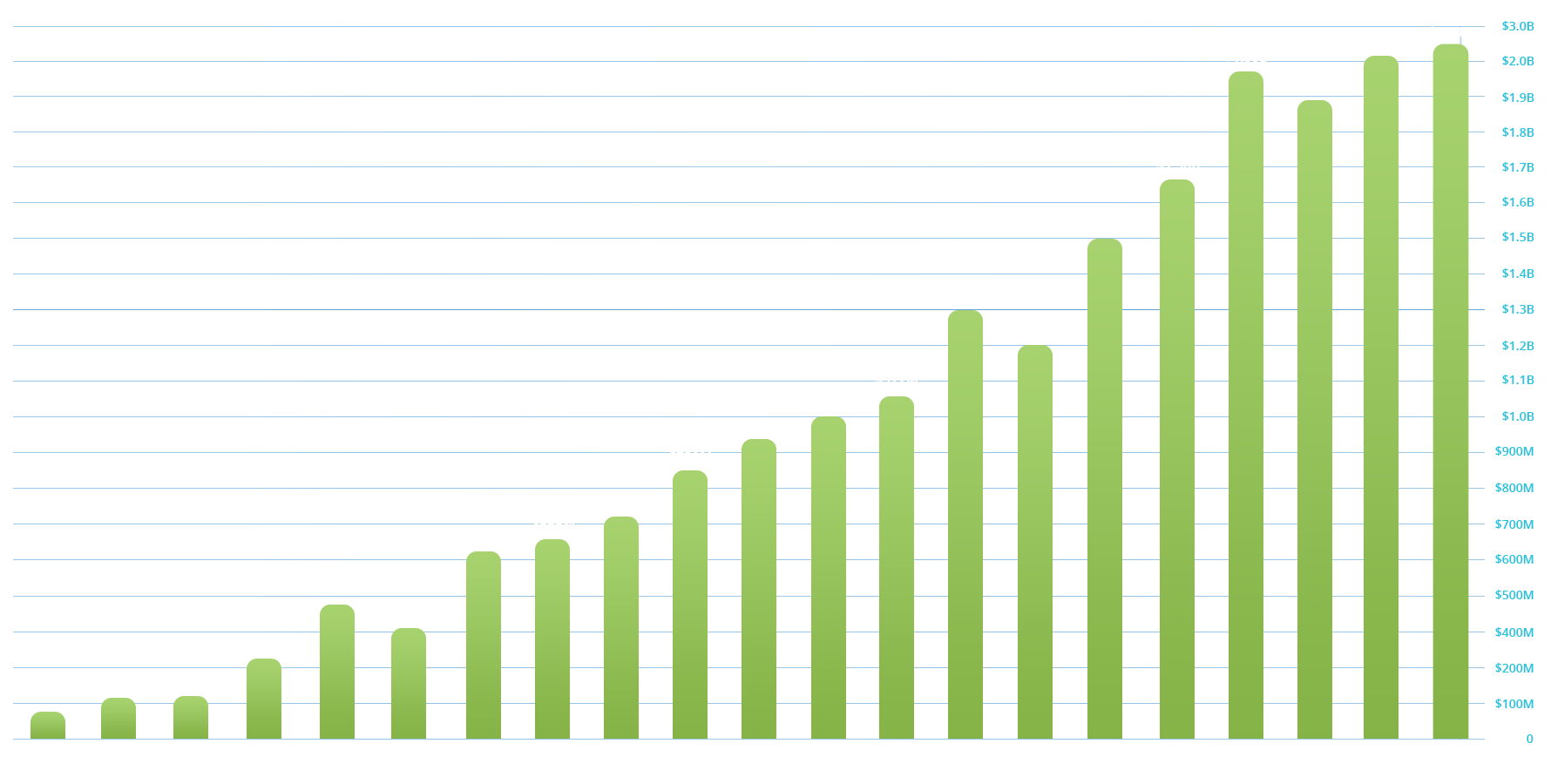

BEDEL FINANCIAL GROWTH BY CLIENT INVESTMENT ASSETS

(DISCRETIONARY ASSETS UNDER MANAGEMENT)

Values as of December 31st of each year

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.