Sub-heading

Info about the page.

Test video - info here.

Single article embedded with module. Test

Completing a FAFSA? These Easy Steps Can Save You Time and Money

Following these four steps will take some time, but probably not as much time as you think. And, when you follow these steps, the likelihood of qualifying for financial aid increases incalculably.

COVID-19: Impact on Student Loans & 529 Plans

Many students have financial decisions to make due to the COVID-19 pandemic. How does the CARES Act affect student loan borrowers and those who used a 529 plan for college expenses?

Do 529 Plans Jeopardize Financial Aid?

Saving for college is important. However, maximizing financial aid may be the difference between going to college and sitting out. The funding of a 529 College Savings Plan has many benefits, but what’s the impact on a student’s financial aid calculation?

The 529A Savings Plan for those with Disabilities

Caring and helping with financial support for individuals with special needs can be complex. The 529A plan is a good savings vehicle to enhance the financial wellbeing of those with disabilities.

What You Need to Know to Save For College and Save On College

The cost of attending college continues to rise and there is little we can do to alter this trend. If you are planning to assist with education costs for your children, you'll not only have to start saving earlier but you'll have to save smarter as well. “Education Funding” covers the pros and cons of the most popular savings vehicles. It also provides information on funding sources and gives you some financial strategies that can help your education funds go further.

this is our ebook - so we can add from the Resources page if there's anything there as well.

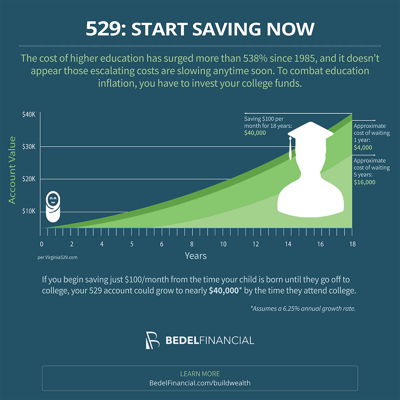

Putting as little as $100/month into a child's 529 could help you afford the surging cost of higher education.

Learn more in the Family Financial Planning chapter of our How To Build Wealth in Your 40s series.

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.