Sub-heading

Info about the page.

Test video - info here.

Single article embedded with module. Test

The Private College 529 Plan – an Alternative for College Savings

While Private 529s allow you to buy certificates to lock in current tuition rates for participating colleges, they don't allow you to invest your savings in marketable securities.

I’m 27: Here’s My Student Loan Repayment Strategy

As important as it may feel to conquer your student loan debt, do not lose sight of setting money aside for your future. Develop a savings strategy that aligns with your financial goals.

Tempus Fugit – Time Flies

The most important thing about college savings was to begin. I do not know about other parents, but for me, one of my first thoughts after regaining my senses was about the cost of college.

COVID-19: Impact on Student Loans & 529 Plans

Many students have financial decisions to make due to the COVID-19 pandemic. How does the CARES Act affect student loan borrowers and those who used a 529 plan for college expenses?

What You Need to Know to Save For College and Save On College

The cost of attending college continues to rise and there is little we can do to alter this trend. If you are planning to assist with education costs for your children, you'll not only have to start saving earlier but you'll have to save smarter as well. “Education Funding” covers the pros and cons of the most popular savings vehicles. It also provides information on funding sources and gives you some financial strategies that can help your education funds go further.

this is our ebook - so we can add from the Resources page if there's anything there as well.

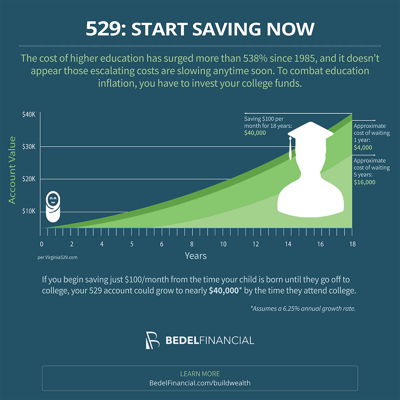

Putting as little as $100/month into a child's 529 could help you afford the surging cost of higher education.

Learn more in the Family Financial Planning chapter of our How To Build Wealth in Your 40s series.

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.