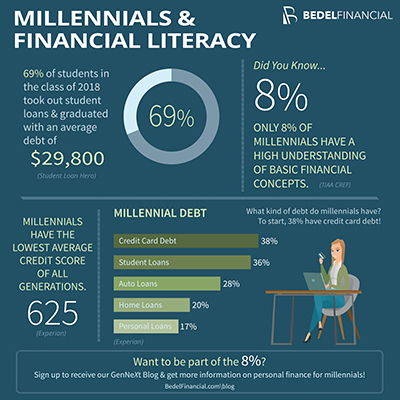

Studies have shown that Americans do not have a high level of financial literacy. Furthermore, millennials have been identified as the subgroup with the weakest proficiency. According to a recent TIAA CREF study, only a mere 8 percent of millennials have a high understanding of basic financial concepts.

Every day we make decisions that impact our personal finances. Understanding the implications of those decisions is difficult when you don’t fully grasp the concept to begin with. Financial literacy is directly related to financial independence. And what millennial doesn’t want financial independence?

What is financial literacy?

Investopedia.com states that financial literacy is the ability to manage personal finance matters in an efficient manner. It includes areas such as investing, insurance, real estate, college funding, budgeting, retirement and tax planning. Being financially literate means making informed decisions and realizing that every decision comes with a consequence.

Not sure where you fall on the financial literacy scale? Financial Industry Regulatory Authority (FINRA) recently conducted a national study on financial literacy. It consisted of a quiz covering important financial topics such as compound interest and inflation. FINRA now offers the five-question quiz on its website. If you fall short of 100 percent, you’re not alone. Indiana participants have posted an average score of 3.19, or 63.8%, which barely edges out the national average of 3.16. On most grading scales this merits a D!

A unique generation

Millennials are an interesting group for a number of reasons. Their different lifestyles depict a new type of financial picture. Millennials are more likely to postpone moving out of their parents’ homes and delay marriage. Trends like these carry a significant impact on their financial status.

Millennials are the most college-educated generation, with 36 percent of women and 29 percent of men having completed a minimum of a bachelor’s degree, according to Pew Research. On the flipside, they also have the most college debt. According to Student Loan Hero, 69 percent of the class of 2018 college students took out student loans and graduated with an average debt of $29,800. And millennials have the lowest credit scores, according to credit provider, Experian. While 36 percent of millennials have student loan debt, an even higher percentage (38 percent) have credit card debt. These factors make it easy to see why a lack in financial literacy is an alarming issue for this generation.

Knowledge is power

What steps can you take to improve your financial literacy? First of all, start now. The earlier you can understand intimidating topics such as mortgages, taxes and social security, the better. There are many resources that promote and teach financial literacy. Do as millennials do and pick up your smartphone! Apps like Mint can categorically track your spending and help you understand the budgeting process. Parents are an often overlooked resource. They have years of valuable experience in budgeting, saving for retirement and paying off a mortgage. You might as well benefit from it!