Planning for Retirement: Goals Overview

Retirement looks different for everyone...

It’s an incredibly personal choice that reflects your wishes for the “golden years.” Whatever your dream retirement might look like - whether you’d like to travel the world, enjoy life with your grandkids, or become an entrepreneur - defining your retirement goals is key.

Ask yourself this:

“What do I want?” Defining your specific retirement goals in detail will help you in steps two and three.

Read More: What's Your Retirement Vision?

Consider the costs.

How much do your lifestyle choices truly cost? How much cash flow will your portfolio need to generate to support these choices?

Prioritize!

Your retirement dreams can be expensive, so it’s critical to decide which goals are must-haves and which are nice-to-haves, and focus your savings accordingly.

Grow Your Money

Invest early and often!

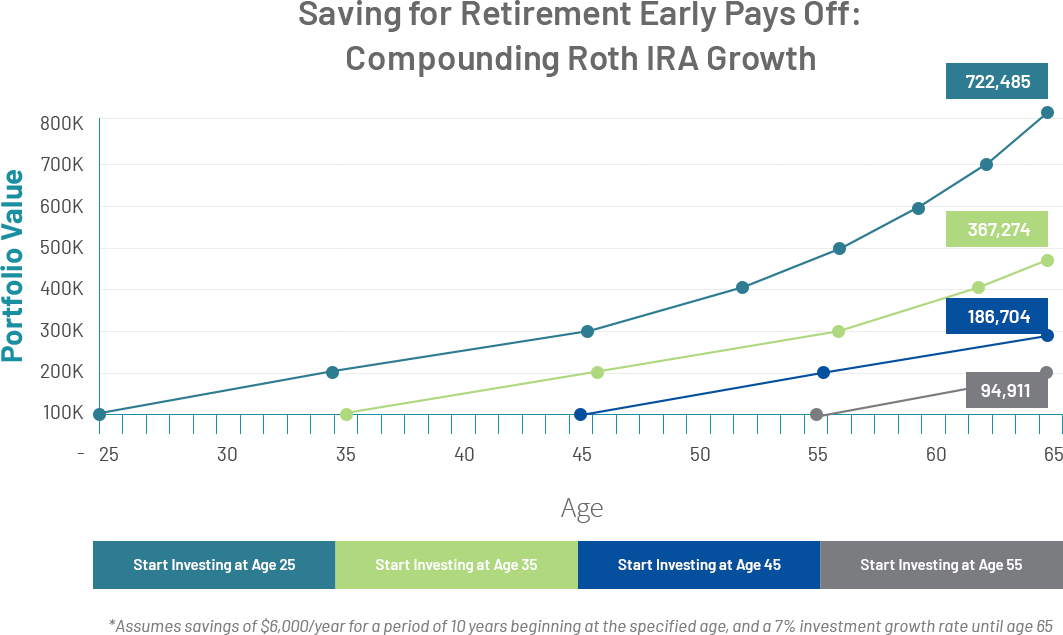

That’s a mantra here at Bedel... But, as you can see in the Financial Life Cycles graphic, your 40s aren’t exactly early in your financial life. So...is now too late to start saving? The answer is absolutely not! As we mentioned, your 40s are great catch-up years. The below graphic demonstrates the importance of maximizing your savings no matter your stage of life.

Sure, maximizing savings at age 25 is more powerful than at age 45, but 45 is better than 55!

Unsure how your retirement savings and planning stack up?

Download our RETIREMENT PLANNING CHECKLIST to see where you stand.

Saving for Retirement

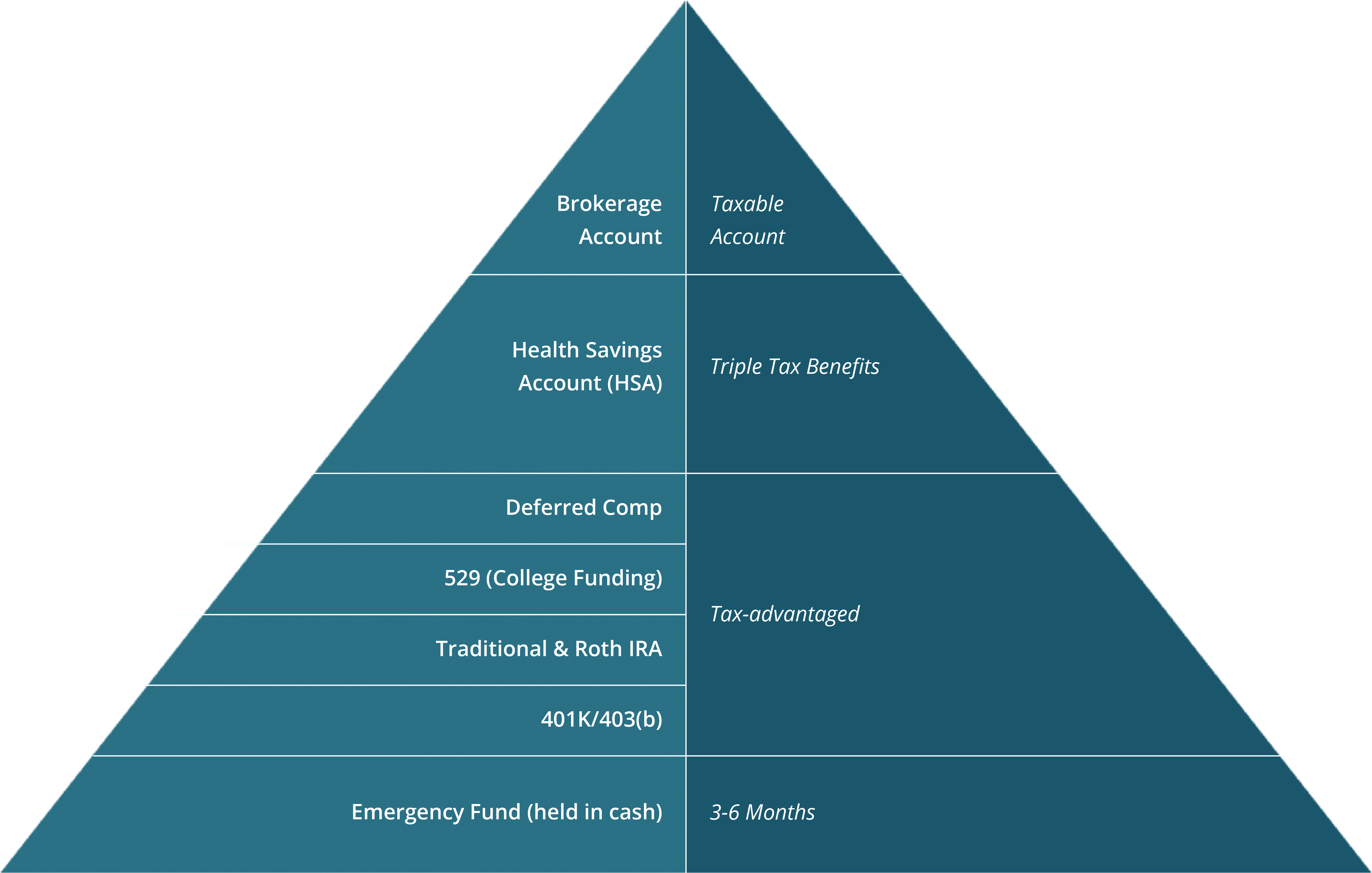

Think of saving for retirement as a pyramid - you can’t build upwards until you’ve established a solid foundation, namely your 401k. Once you’ve built that foundation, you can continue building up with other investment vehicles like HSAs, IRAs, Roth IRAs, and brokerage accounts.

Ideally, we recommend maximizing all of your retirement contributions; but that’s not always realistic.

If you’re looking for a first step, a great place to start (at any age) is maximizing your employer match in your retirement plan! If you aren’t taking advantage of this commonly-offered employer benefit, you’re missing out on free money. Be sure you know your plan’s matching percentage and take advantage of it; i.e., if your employer matches the first 5% of your 401(k) contributions, then you need to contribute at least 5% to get those free dollars from your employer.

Once you have the basic matching taken care of, then you can consider the IRS limits for retirement account contributions. These can change on an annual basis, so checking the IRS website for the current year’s limits and restrictions is a good idea.

Early Retirement Investment Strategy FIRE

If income allows, you could consider the FIRE movement - Financially Independent Retire Early. “Firing” is aggressively saving with the intention to retire from corporate America ASAP. There are several things to keep in mind if you’re planning to retire early.

1

Have a solid financial plan in place and keep your budget lean

2

Be ready to compromise - think off-brand items, driving used cars and taking bare-bones vacations

3

Implement a safe, low-cost investment strategy, including income-producing investments like bonds or dividend-paying stocks

4

Consider longevity risk - the risk of outliving your assets