How To Make Tax-Efficient Investments

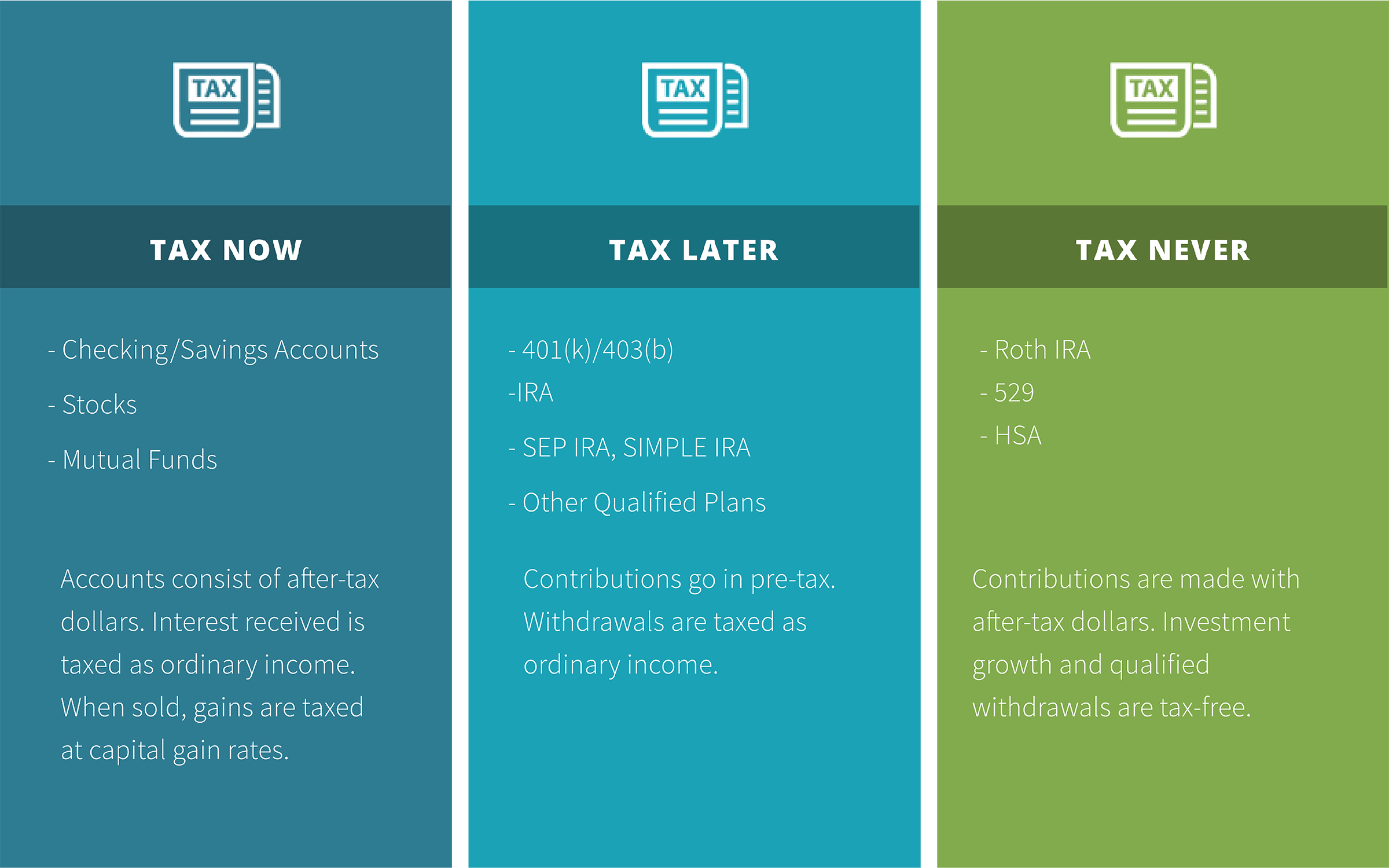

Your investment strategy shouldn't be focused solely on tax efficiency but having a mix of pre-tax, after-tax, and tax-free monies provide balance and flexibility that is important down the road.

Let’s assume for a minute that you’re retired, and you’ve already pulled $20,000 from your tax-deferred investment account (e.g., IRA or 401k). Any money you withdraw from a tax-deferred account is taxed at normal taxable income levels. Now let’s assume that your current withdrawal has put you in the 22% tax bracket. You decide that a dream trip in the fall is just what the doctor ordered. Which account do you pull the money from to pay for this trip?

In this case, it makes more sense to pull from your tax-free investment account (e.g., Roth IRA) - this allows you to withdraw your vacation money tax-free, leaving you in your current tax bracket.

As you can see from this example, having a combination of both tax-deferred and tax-free money set up for retirement allows you to manage your tax bracket during retirement. Read More: How to Make Tax Efficient Investments

Taxation of Investment Accounts

Income Tax Strategies

Everyone dislikes paying taxes; however, not everyone is aware of the various ways they may be able to reduce their taxes today.

Employer Retirement Plan

Max out your yearly contributions to your employer retirement plan. If you are self-employed, there are retirement plans you can create for yourself that can significantly reduce your taxes, such as Solo 401(k)s and SEP-IRAs.

IRA Contributions

Depending on your current income, you may be eligible to make a deductible IRA contribution. If you are married and your spouse does not work, he or she may still be eligible to make a deductible IRA contribution. How much you earn limits whether IRA contributions are deductible for you and your spouse.

Health Savings Account

If you are enrolled in a high deductible health care plan at work, see if it offers a Health Savings Account (HSA). If you are, max out your contributions each year. As long as the money is used for a qualified health expense, the HSA distribution is tax-free. Plus, your contribution is tax-deductible - a win-win situation. See more below and check out our HSA Resource Page.

Save for College

If you have children and want to save for college, make a contribution to a 529 plan for them. Indiana residents may qualify for a state tax credit by contributing to a 529 plan. Even better? Grandparents contributing to their grandchild’s 529 are eligible for the Indiana state tax credit too. Read More: 529 Plan Resource Page.

Charitable Gifting

Charitable gifting strategies have changed due to the new tax law. If you no longer itemize your deductions, you may want to consider lumping multiple years’ gifts into one tax year to boost your deduction. This article goes into more detail on that strategy that can earn you a Triple Tax Benefit!

Donating to Scholarship-Granting Organizations

If you donate to a scholarship-granting organization (SGO) approved by the Indiana Department of Education, then you may be eligible for a 50% state tax credit with Indiana, plus the donation is eligible for a deduction on your federal tax return. That is two tax benefits for one gift.

Read more: Scholarship-Granting Organizations

Child Tax Credit

The Child Tax Credit had a complete overhaul in the recent tax bill. If you weren't eligible in previous years, you might be now.

Read More: New Child Tax Credit: Will You Benefit?

Taxes can play a big role in investing, and the type of account that is most beneficial in a situation is an integral part of an investment plan. Every investor's tax situation is unique.

Contact us today to learn which tax-saving strategies might make sense for your situation.

Read More: 4 Essential Tips for Investing in Your 40s

Diversify Your Investment Portfolio

“Diversify. In stocks and bonds, as in much else, there is safety in numbers.”

-Sir John Templeton

Diversification in your 40s is just as important as at any other age. However, you’re now in the middle part of your financial life where you’ll start investing more conservatively than you did in your 20’s and 30’s. You still need growth from those more aggressive investments as you still have several years until retirement. Making sure your entire portfolio is properly diversified can sometimes be difficult because of the multiple investment options out there. It is more complicated than simply choosing between stocks and bonds.

Should you invest in:

- Domestic vs. International stocks?

- Small companies vs. Large companies?

- Traditional investments vs. Alternative investments? Adding Alternative Investments

- What about Socially Responsible funds? Socially Responsible Investing

A well-diversified portfolio will have exposure to various different investment strategies. On top of that, as you get older, more accounts are usually being added to your portfolio.

For instance, you may have a couple of retirement accounts from past jobs. Nearly 30% of employees have left a 401(k) behind when changing jobs. Who has the time to manage a handful of investment accounts at different institutions? Read More: What Should I Do with My Old Retirement Accounts?

Consolidating accounts and having your assets with one advisor to take advantage of comprehensive advice that includes both investments and financial planning can take the weight off of your shoulders.

Comprehensive Wealth Management = Investments work hand-in-hand with your Financial Plan.

Prior to implementing any investment strategy referenced in this article, either directly or indirectly, please discuss with your investment advisor to determine its applicability. Any corresponding discussion with a Bedel Financial Consulting, Inc. associate pertaining to this article does not serve as personalized investment advice and should not be considered as such.