Estate Planning Considerations

Now that you’re in your 40s, it’s important that you review your current estate documents or get to moving on drafting them ASAP. Estate planning is all about protecting the ones you love, and questions about how to accomplish that can be daunting.

What questions keep you up at night?

- Who will take care of my children if something happens to me?

- Who will inherit my assets when I’m gone?

- Who will take care of me if I’m unable to take care of myself?

- What happens to my business if something happens to me?

Even if you don't find yourself tossing and turning at night, it's still essential to put a plan in place that answers these questions.

So, what should you be considering? Below is a list of the basic estate documents and a short explanation of each.

Estate Planning Documents

Last Will & Testament (Will)

Your Will is where you name the person who is to handle your estate (Executor or Personal Representative), indicate who is to receive your assets and how (beneficiaries), take care of your young children (guardian), and how to pay for final expenses and outstanding debts.

Read More: With a Will, It’s Done Your Way

Revocable Living Trust

A Revocable Living Trust is like a Will; however, instead of an Executor, you would appoint someone to act as trustee of the trust after you're gone. The assets in the trust are not subject to probate, and the trust document is private (unlike the Will). During your lifetime, you can make changes to the trust. Changes cannot be made after your passing.

Read More: Should You Create a Trust?

Power of Attorney

Appointment of a trusted individual to make financial-related decisions and transactions on your behalf if you’re not able. There are several different types of powers of attorneys (limited, durable, springing and, general).

Living Will

Indicates your wishes for end-of-life medical care if you’re unable to communicate them personally.

Healthcare Power of Attorney

Appointment of a trusted individual to make healthcare decisions on your behalf if you’re unable.

These records aren’t the only thing that comprises your overall estate plan.

You also need to consider how your assets are titled and the beneficiaries of your life insurance policies, annuities, and retirement accounts.

Beneficiary Designations

Life insurance policies, annuities, and retirement accounts all give you the option to name a primary and contingent beneficiary for the policy/account. And, because they have assigned beneficiaries, they would not transfer to others via a Will or trust.

It's vital that you review your executed estate documents, ownership of your assets, and beneficiaries of accounts/policies every couple of years to ensure they remain appropriate, especially as you encounter life changes. And remember, these three things need to complement each other to fulfill your desires effectively.

Read More: Who are Your Beneficiaries?

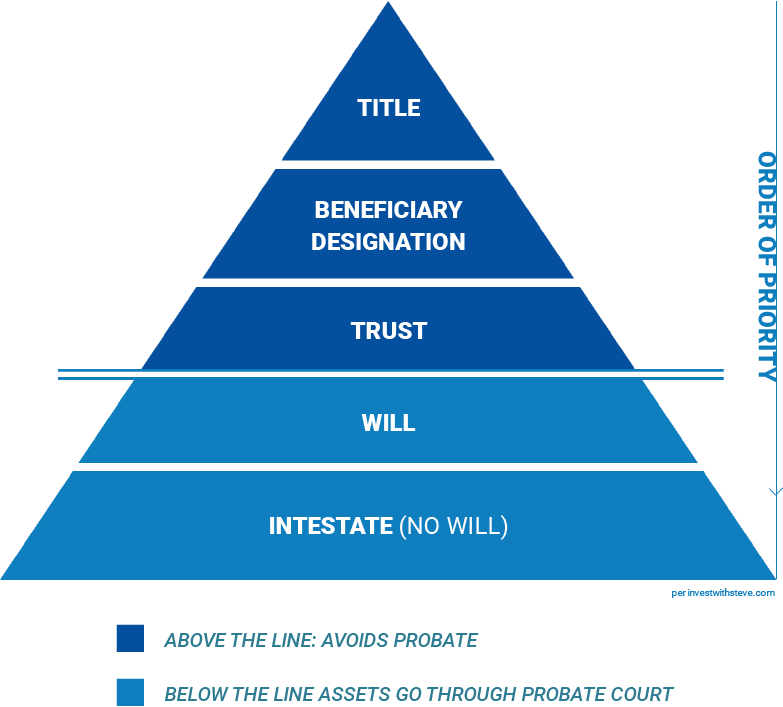

Asset Transfer Pyramid

What's Next?

You've come a long way and accomplished a lot by your 40s, and there's a lot at stake. We can help you evaluate where you are now, talk about where you want to be, and help you build a plan to get there.