Taxes are an important consideration in investing. They should not be the sole driving force behind investment decisions, but investors should take them into consideration.

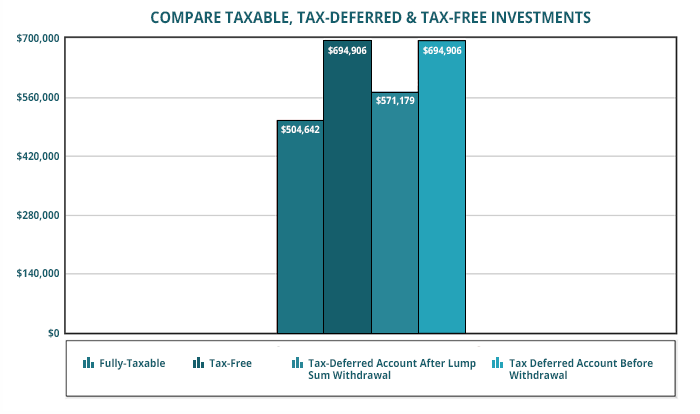

As a starting point, let’s look at a portfolio’s results in three different types of accounts – a taxable brokerage account, a tax-deferred IRA, and a tax-free Roth IRA.

Don’t Overlook Brokerage Accounts

At first glance, the taxable brokerage account looks like the worst option. However, there are other important considerations:

Tax-deferred and tax-free accounts offer limited accessibility (think withdrawal penalties) prior to age 59 ½.

Brokerage accounts offer a lot more flexibility when compared to certain retirement accounts (think 401k plans with their limited investment options).

Some smart moves can help level the playing field for brokerage accounts.

In a brokerage account, there are three types of payouts that can trigger taxes – dividends, capital gains, and interest income. Interest income is taxed as ordinary income while long-term capital gains get more favorable treatment. Dividends can fall into either camp. So-called ordinary dividends are taxed as ordinary income, while qualified dividends are taxed as capital gains.

How to Improve the Return on Your Brokerage Account

A couple of easy tricks for improving a brokerage account’s after-tax return:

Municipal bonds – buying municipal bonds or bond funds will provide interest income that is not taxable at the federal level. While these bonds generally pay lower absolute interest rates, depending on your tax bracket their after-tax yield can be superior to normal bonds.

Tax loss harvesting – this refers to the practice of selling holdings at a loss. These losses can be used to offset capital gains and reduce your tax bill. If losses are bigger than your gains, you can report a loss of up to $3,000 in a given tax year. Anything beyond that gets carried forward to offset future gains.

Paying attention to taxes and minimizing their impact on your portfolio is an important tool for investors. Know the strengths and weaknesses of various types of investment accounts and use each appropriately.

Everyone’s tax-saving strategies can be different based upon their financial situation. Interested in learning more about tax-saving strategies that can benefit you? Schedule a Consultation today!

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.

Prior to implementing any investment strategy referenced in this article, either directly or indirectly, please discuss with your investment advisor to determine its applicability. Any corresponding discussion with a Bedel Financial Consulting, Inc. associate pertaining to this article does not serve as personalized investment advice and should not be considered as such.

Recommended Articles

Trading on Tomorrow: How Prediction Markets are Reshaping the Everyday Investor

For most people, the key will be understanding the risk,...

Navigating Finances After a Terminal Illness Diagnosis

As my family experienced, a terminal diagnosis is...

Worried About an AI Bubble? Three Strategies for Diversification

Ultimately, the appropriate strategy depends on the...