As we are all very aware by now, The Tax Cuts and Jobs Act (TCJA) was signed at the end of December 2017. As a result, individuals and businesses have seen a significant difference in their tax filings going forward. One of the most impactful changes to individuals was the increase in the standard deduction amount. As of January 1, 2019, the standard deduction for single filers is $12,200 and for those who are married, filing jointly it is $24,400. Due to the fact that many taxpayers will no longer be itemizing, an estimated 21 million taxpayers will no longer receive a deduction for their charitable giving. However, with proper planning, there are strategies that can be implemented to both support the organizations you are passionate about and reduce your tax liability. First, let’s review eligible deductions.

Allowable Itemized Deductions:

- Medical expenses – Must be greater than 10 percent of AGI in 2019;

- Property, state, and local taxes – Can be itemized up to a combined $10,000 cap.

- Home mortgage interest payments – Existing mortgages are grandfathered under the previous rules and will remain deductible on a principal of up to $1,000,000. Interest on home mortgages taken out after December 15, 2017, can be deducted on loan principals of $750,000 or less. Interest on home equity loans is not deductible.

- Charitable contributions – Increased to 60 percent of taxpayer’s AGI.

- Casualty and theft losses – “Personal casualty losses” are deductible only if attributed to a declared national disaster.

Manage the Deductibles You Can Control

For medical expenses and casualty and theft losses, potential deductions are unpredictable and out of one’s control. Property, state, and local taxes, as well as mortgage interest, are fairly consistent and are not adjustable.

Charitable Contribution Strategy

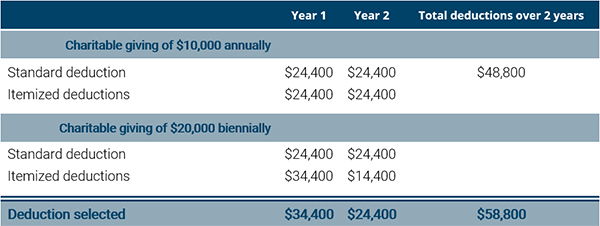

Strategy #1: Double-up. One option is to lump two or more years worth of charitable contributions into one tax year and forego contributions in the following year(s). Doubling up on contributions will help enhance the amount of your itemized deduction.

- Filing Status: Married Filing Jointly

- Standard deduction: $24,400

- Eligible itemized expenses:

- State, Local, and Property taxes $10,000

- Mortgage interest $4,400

- Charitable giving : $10,000 annually or $20,000 biennially

In this scenario, the taxpayer has the benefit of an additional $10,000 in itemized deductions over two years. For a couple in a 24% tax bracket, that is a savings of $2,400; the savings would be $3,700 for taxpayers in the 37% tax bracket.

Strategy #2: Use a Donor Advised Fund. Biennial giving (every other year) may cause you to be concerned regarding the cash flow impact to the organizations you support. Great news! Donor Advised Funds (DAFs) allow individuals to create a personal account to which they can make charitable contributions anytime, but also allow the individual to decide when to distribute funds in the future. The contribution to the DAF creates a charitable deduction in the year the contribution was made. Then, at your discretion, you select what charity(ies) you want to support and when the donation will be made. Continuing with the previous example, a couple could contribute $20,000 into their DAF in 2018, but spread the distributions to charities over the next two years (or beyond). Both Schwab and Fidelity maintain DAFs for our clients.

Strategy #3: Make Charitable Gifts from an IRA. Another strategy applies to those who are over 70 ½ and have traditional IRA accounts. Your annual required minimum distribution (RMD) can be a source of charitable giving. Rather than taking the RMD as a taxable distribution, you can direct up to $100,000 to a charity(ies) as a Qualified Charitable Distribution (QCD). The distribution must go directly from the trustee of your IRA (e.g. Schwab or Fidelity) to the charity. This approach not only allows you to use your RMD to fulfill your charitable intentions, it also reduces your Adjusted Gross Income (AGI) because the amount of the QCD is not included as taxable income for the year. This is important since the amount of your AGI impacts both Medicare premiums and taxation of Social Security. (Note: Since the IRA income was not taxable to you, you do not receive a charitable deduction for a QCD.)

The strategies referenced above are all viable solutions; however, the impact on a tax return will vary based on one’s circumstances. If you have questions about the items above or any other issues related to your situation, please contact us.

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.

Recommended Articles

How the One Big Beautiful Bill Act Impacts Charitable Giving

There will be significant changes to charitable giving in...