CHAPTER 1: INTRODUCTION

Your 40s are a Balancing Act

Welcome to your 40s –the decade of the balancing act! By now, you’ve probably established your career, your earnings have grown, and you’re hopefully saving for the future. You’re likely in a good place. But now is the time when competing goals emerge – things like kids’ college savings, a larger house, perhaps helping your parents as they get older, and saving for retirement. As you walk the fine line between your competing goals, it can often be easy to lose focus on your savings and spending habits.

Now is the best time to take your saving, growth, and protection of your money to the next level. Make sure you are doing all you can to be strategic about your money and optimize your financial situation. We’re here to help with that!

There’s a lot to think about in your 40s when it comes to finances:

Have I saved enough for my children’s college education?

Will my parents need my financial help in the not-so-distant future?

Can I retire when I want to and maintain the lifestyle I desire?

Is there any way I can reduce my tax liability?

What happens to my family if something happens to me?

Will my insurance plan really cover me for those “what ifs?”

With these questions and many more swirling in your head, it’s easy to get overwhelmed. We hope this guide, “How to Build Wealth in Your 40s” will act as a resource for all the forty-somethings out there that want to stay on the right track, but might need a bit of guidance.

From retirement planning to tax strategies to caring for aging parents and much more, we walk you through the areas you should be focusing on in your 40s to help you accomplish your financial goals and take your wealth to the next level.

So, where do you start?

How Much Should I Have Saved By 40?

The commonly accepted rule of thumb is to have two times your current salary saved by 40, and three times your salary saved by 45. Not there yet? Good news, your 40s are known as the catch-up years when it comes to saving.

These are typically the years when you reach your peak earnings potential. It can be a time in your life when it’s more realistic to increase payment amounts for goals like debt reduction, retirement savings, and college savings. But, it’s also the time in your life when there are expenses coming from every angle, and “Keeping up with the Kardashians (Joneses)” is in full effect.

How can you be sure you’re on the right track to reach your financial goals?

First, you need to define your financial goals. Retirement is important, but it’s not the only important financial goal in your 40s. Financial planning should include all aspects of your financial life, not just your long-term retirement goals. Here are a few things to keep top-of-mind:

Emergency Fund to Avoid Credit Card Debt:

Keep 3-6 months worth of living expenses available in your savings account. This cash allows you to be prepared for the unexpected and will help avoid high-interest credit card debt. 71% of Americans do not have 6 months' worth of expenses saved in an emergency fund (Bankrate.com), so we hope you’re in the minority.

Read More: Emergency Funds: For When the Unexpected Happens

Check out our Emergency Fund Infographic

Education Savings & Short-term Goals:

If you plan to buy a new car, house, or send your children to college, have a savings plan in place. If you don’t save for your short-term goals, you’ll be required to borrow and pay interest to a bank. These payments, plus interest, can impair your ability to save for retirement on a monthly basis. When saving for college, your residing state’s 529 Plan is typically the best option, depending on the tax benefits for state residents. However, if you’ve waited too long to save for your child’s college education and need to prioritize your savings goals, always remember - you can borrow for college, but you can’t borrow for retirement.

Balancing Retirement Savings with Debt Reduction:

Sure, it’s ideal to go into retirement debt-free. However, carrying a low-interest, tax-deductible mortgage balance isn’t necessarily a bad thing. Especially if you are able to keep your other money invested for the purpose of receiving a higher rate of return than the interest you’re paying on your mortgage. Don’t sacrifice your retirement savings to be debt-free in retirement - you’re not better off being debt-free if you have no spending money in retirement.

Retirement Savings:

Staying on track to meet future spending needs is vitally important. If you wait too long to save, you may not have the resources to make up for those underfunded years. The earlier you save, the more opportunity you have to earn free money through investment growth, or compounding interest.

So, How Much Should I Have Saved by the End of My 40s?

Fidelity’s research says you should have 6x your annual salary at age 50, but it depends on your goals. We hope the rest of this guide will help you get closer to understanding and reaching your goals. Everyone’s financial situation is different, and many don’t have the time, energy, or expertise to manage their financial plan and investments alone. Consider seeking out a financial advisor, like us, to help you find your personal retirement number.

How to Take Advantage of Your 40s’ Earning Power

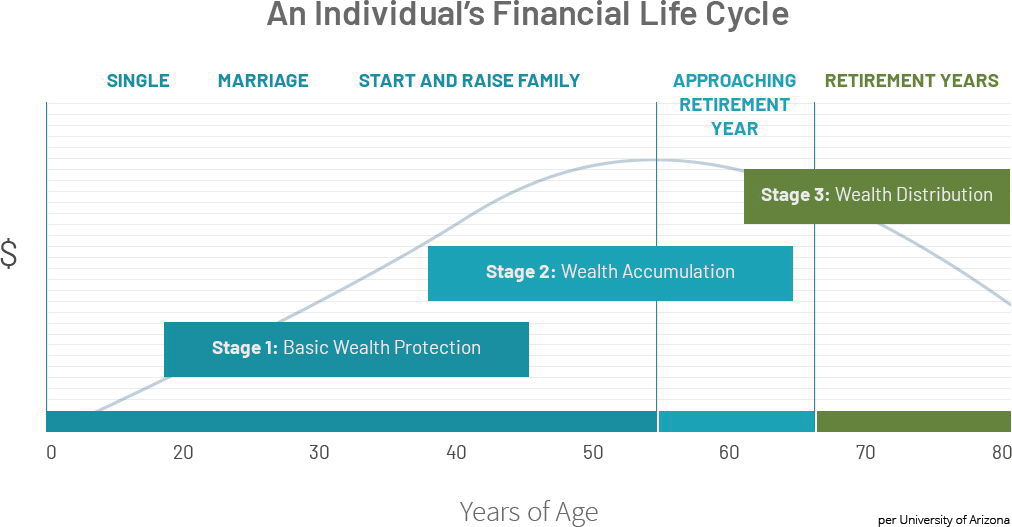

Your 40s are a unique period in your financial life cycle.

You’ve graduated the basic asset protection phase and cruised into a period of wealth accumulation. It’s likely that you’ve hit your stride at work and are reaping the benefits as emphasized in your highest earning years. Are you taking advantage of this life stage?

We often see individual investors fixate on one number: returns. This can be a dangerous mindset. At the onset of your career, and throughout your high earning years, your primary focus should be on your savings rate. The example below highlights the problem with investors who focus solely on returns.

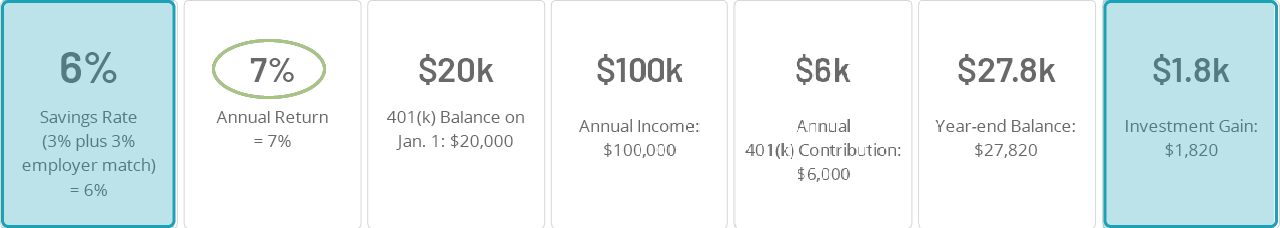

Situation 1

A 7% return is great, but when your account is small, your contributions will have a more significant impact on increasing your balance. There does come an inflection point where returns become more influential than savings percentages.

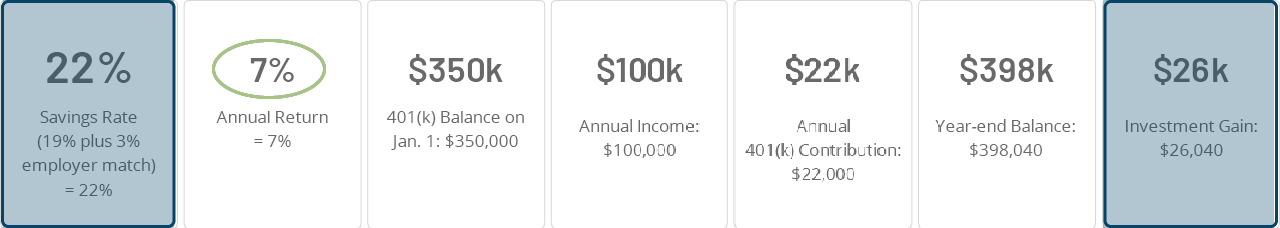

Situation 2

In this example, despite making a maximum contribution (plus 3% employer match), the market return was more impactful than the contributions. This only happened because of the size of the investment account. The fastest way to get to this inflection point is to increase your savings rate! It’s difficult to make drastic increases to your savings percentage.

Quick Tip: As you receive pay increases, also increase your 401(k) contributions and maintain your standard of living.