Jonathan Koop, CFA

Sr. Portfolio Manager and

Manager of Investment Management

As a Sr. Portfolio Manager I work to ensure that each client's investment portfolio is properly aligned to help them achieve their unique financial goals. Through research and analysis on the Investment Committee, I identify new attractive investment opportunities and regularly monitor our current investments. As Manager of Investment Management my role is to oversee the day-to-day operations of each of the members of the Investment Team to ensure that we are providing the best service to our clients as efficiently and effectively as possible.

Personal Investment Experience

- Over a decade of experience in the financial services industry

- Experience includes investment research and analysis of large private wealth and institutional clients, as well as the developing and monitoring of investment portfolios to meet client goals

Career History

- Bedel Financial Consulting, Inc., Sr. Portfolio Manager

- Cambridge Associates, LLC, Sr. Investment Associate

- Edward Jones, Financial Advisor

Education

- Awarded Chartered Financial Analyst designation

- Master of Arts and Letters, Education, University of Notre Dame, 2012

- Bachelor of Arts and Letters, Economics and Political Science, University of Notre Dame, 2010

BLOG POSTS

Silicon Valley Bank and the Bank Term Funding Program (BTFP)

The Fed's actions prevented a widespread run on the banks. However, market volatility will ensue as investors weigh the quickly changing landscape in the U.S. and abroad.

Secure 2.0 Act: What Does it Mean for You?

In late December of 2022, Congress passed, and President Biden signed the $1.7 trillion omnibus spending bill. One part of the bill is the SECURE 2.0 Act, which expands on the original SECURE Act of 2019 by enhancing many features related to investors.

The Doves Have Left the Nest

Statements by Fed Chairman Jerome Powell on August 26th poured cold water on the stock market rally. Powell has been using strong language to reiterate the Federal Reserve's position that tackling inflation remains the central bank's number one priority, and they intend to maintain this policy even if it causes "pain" to the markets or economy.

High Inflation, Strong Dollar…A Contradiction?

While a strengthening dollar has provided relief for US consumers against inflation, if the dollar were to fall against other currencies, this benefit would dissipate and expose Americans to further inflation from increasing import costs.

Are We Headed For a Recession? Were We In a Recession? Does it Matter?

After the Federal Reserve began raising its Federal Funds discount rate, the headlines predictably shifted to guess whether these actions would cause an economic slowdown and a recession.

Market Jitters - Don’t Panic!

As equity and fixed income assets across the globe decline in unison, it is imperative to tune out the noise of day-to-day headlines and remain committed to the strategy of a personalized financial plan.

Give your Portfolio a Boost: Diversify During Cyclical Markets

Cyclical markets can be unsettling: increased market swings and volatility can scare even the most seasoned of investors. But these market cycles can be used to your advantage. Jonathan explains how to make the market cycles work to your portfolio’s benefit.

Hawkish Fed: Good for Your Portfolio?

The Fed has tremendous influence over the economy and the markets. After years of stimulus, it must navigate an unenviable balancing act of combating inflation without rattling confidence in the markets.

Wow! Inflation over 7%

This inflation rate far surpasses the Federal Reserve's target of achieving an average inflation rate of 2% per year. Yet, despite this data, Fed Chair Jerome Powell has dismissed inflation concerns throughout much of the year because he believed higher prices were 'transitory.'

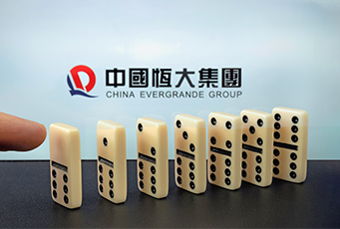

China’s Real Estate Problem

With the real estate bubble that has been the driving force behind China’s explosive growth deflating, future growth must come from elsewhere.

Reset Your Expectations

Stocks inevitably encounter rough patches and periods of increased volatility. While investors have benefited from seven straight months of increases in the equity markets, it is important to remember the cyclical nature of markets.

Take the Job or Unemployment?

The impact of COVID-era federal programs and interventions is still with us. Barring an extension of the federal unemployment insurance program from Congress, these benefits will expire in just a few months and could provide a tailwind for employment and growth.