At Bedel, we preach the mantra “invest early and often” to our Generation NeXt clients because we understand the flexibility it gives the future you. Flexibility means different things to different people. For some, it’s the ability to retire early or step away from a soul-crushing job to pursue a passion project; for others, it’s the ability to help aging parents or purchase a vacation home. No matter how you define it, tax diversification is an important piece to “afford” flexibility.

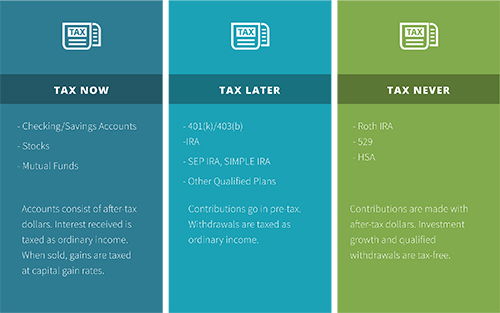

Tax diversification is the result of saving to different types of investment accounts. Every account falls into one of three buckets: tax now, tax later, and tax never. Spreading your money into each of these buckets allows you to manage your tax bracket better and provides access to investments at any age. Below is a high-level explanation of the tax buckets.

Tax Now.

The most common example of a “Tax Now” account is a brokerage. Investment income, such as capital gains, interest, and dividends, is taxed annually. The upside to being taxed annually is that capital gains tax rates are more favorable than ordinary income tax rates. Another benefit to taxable accounts is that you can access the funds at any time, and there are no annual contribution limits or phase-outs.

Tax Later.

Like 401(k)s and IRAs, tax-deferred retirement accounts are prime examples of “Tax Later” accounts. You defer taxes or deduct income during your contributing years and pay Uncle Sam upon withdrawal. Every dollar exiting a tax-deferred account is taxed at ordinary income rates. There are several important rules to be aware of, including annual contribution limits, early withdrawal penalties, eligibility requirements.

Tax Never.

Roth IRAs and Roth 401(k)s make up the “Tax Never” accounts. Contributions are made with after-tax dollars, and the investments grow tax-free. Distributions from Roth accounts are not taxable, making them the ultimate account for tax-bracket management during retirement. Similar to the Tax Later accounts, there are several rules to keep in mind.

In order to showcase the benefits of a tax-diversified portfolio, let’s look two examples:

Example One: Michelle reached her ultimate goal of retiring by the age of 55. She needed $90,000 to live off during her first year of retirement. In order to avoid the 10% penalty for withdrawing from retirement accounts prior to the age of 59 ½, Michelle sold $90,000 worth of investments in her brokerage account, triggering $65,000 of long-term capital gains. All but $12,600 of the gains fell into the 0% long-term capitals bracket, leaving her with a $1,890 tax bill!

Example Two: In December, Greg and Lisa talked about treating their extended family to a $10,000 vacation over the holidays. Having withdrawn nearly $170,000 from their IRAs that year, they were nervous to add to their modified adjusted gross income in fear of increasing their Medicare premiums. They settled on a $10,000 tax-free withdrawal from Lisa’s Roth IRA and booked the vacation.

Too often, we see retirees with all their money tied up in their 401k, which can result in a ticking tax bomb. Plan while time is on your side and make an effort to add dollars to every bucket. Future tax rates and retirement account rules are unpredictable; the best you can do is to make intentional decisions based on the information you know to be true today. And remember, invest early and often!

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.

Recommended Articles

Navigating Finances After a Terminal Illness Diagnosis

As my family experienced, a terminal diagnosis is...

How the One Big Beautiful Bill Act Impacts Charitable Giving

There will be significant changes to charitable giving in...