Welcome to To Your Wealth, a simplified, weekly, personal-wealth Q&A! Sometimes you just don’t know what you don’t know…Or perhaps you just have that one issue keeping you up at night. Either way, every Tuesday, we’ll be answering one of your personal finance questions, so be sure to keep those queries coming. Click on Submit a Question below, and then keep an eye out for when your question will be featured!

- 1. I’ve created a trust fund for my kids. When and how do I tell them?

- 2. My family member recently passed away and I inherited their estate. Will I owe taxes on my inheritance?

- 3. I own my own business. Can I hire my teenage children to work for me?

- 4. My spouse & I are thinking about buying a vacation home and are curious about any tax impacts we might experience (due to TJCA Tax Reform) if we finance the purchase.

- 5. We want to save for our children’s college education. Is there a way to jump start our savings this year with a larger contribution to their 529 accounts without incurring a gift tax?

- 6. I purchased a $5 million life insurance policy 5 years ago to provide for my family if I pass prematurely. Will the death benefit negatively impact my family’s inheritance due to a higher estate tax liability?

- 8. Can I continue to contribute to my Health Savings Account after I retire?

- 9. I have $200,000 of company stock in my 401(k) with a cost basis of $25,000. Someone mentioned that I can roll it out of the account under the NUA Rule. What is the NUA Rule and how does it work?

- 10. I’m getting ready to sell my house. Where can I get the most “bang for my buck” when making upgrades?

- 11. I’m purchasing my first home and am unsure what replacement cost option I should choose for my homeowners insurance. What are my choices?

- 13. What’s an appropriate amount of money to spend on a wedding gift?

- 14. I use budgeting apps but still can’t seem to stick to my budget. Where do I go from here?

- 15. I just inherited money. What should I do with it?

- 7. When should I use my debit card and when should I use my credit card?

- 17. I’d like to begin introducing my elementary-age children to financial concepts. Where should I begin?

- 20. I’m going to Europe soon. What happens if I get injured there?

- 21. My child is 18 and heading off to college in the fall. Are there legal documents I/we should consider prior to leaving the nest?

- 23. I’ve heard of the Backdoor Roth IRA strategy, however, I recently came across the term Mega Backdoor Roth IRA. How does this strategy work?

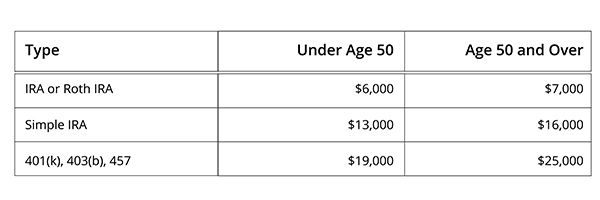

- 25. What are the contribution limits for various retirement accounts in 2019?

- 27. Life Insurance: When do I need it?

- 28. Life Insurance: How Much Do I Need?

- 29. Life Insurance: What type do I need?

- 31. Our first grandchild just arrived and we’d like to open a 529 college savings account for him. How do I know what plan is best, and does he have to go to college in the state of the 529 account we choose?

- 32. I know a little bit about the HIPAA law and recently heard that I won’t have access to my children’s health care providers/records after they turn 18. Is this true?

- 33. What is disability insurance? Do I need it?

- 34. What type of disability insurance do I need? And how much?

- 35. What else do I need to consider when obtaining a disability insurance coverage?

- 36. I’m planning to give my son a puppy for his 10th birthday. Should I buy pet insurance for it?

- 37. Can I name a trust beneficiary of my IRA, rather than my children individually?

- 38. What is Small Business Saturday all about?

- 39. I know I need an emergency fund and I’ve always heard it should contain 3-6 months of living expenses. So, should I shoot for three months or six?

- 40. What end-of-year tax planning should I be doing?

- 41. How will the impeachment proceedings against President Trump affect the market and my investments?

- 16. I just applied for Social Security benefits – when can I expect my first check?

- 12. How do I know when it makes sense to refinance my mortgage?

- 18. My parents are in their 80s and I worry about them falling victim to a scam or fraud. Is there anything I can do to prevent this from happening?

- 19. My 401(k) offers a Roth option. Should I contribute to it?

- 22. Should I list my children [ages 8 & 6] as beneficiaries to my retirement accounts?

- 26. What is a wash sale?

- 30. Life Insurance: Should I buy life insurance for my child?

1. I’ve created a trust fund for my kids. When and how do I tell them?

To Your Wealth - March 5, 2019

It’s difficult to pinpoint the perfect moment to have that conversation but there are certainly some prerequisites. First, make sure your children have demonstrated an understanding of personal finance topics such as budgeting, saving, and debt. Other indicators that your child is ready to know about your generous gesture may include maturity, responsibility, and work ethic.

Once you’ve determined your child is ready to know, let the trust language tell the story. Make sure they understand whether there are restrictions on when or why they have access to the money. For example, a trust may be earmarked for the down payment on a home or the funds may become available once the beneficiary graduates college. If the recipient has free reign on trust assets, be sure to communicate your expectations, whether it be entrepreneurship, philanthropy, or other guiding principles that will help them be good stewards of your hard-earned wealth.

2. My family member recently passed away and I inherited their estate. Will I owe taxes on my inheritance?

It’s very unlikely, but it depends. There are three possible taxes involved. The first is estate tax, which is levied at the federal level. If the value of your family member’s estate is under the lifetime exclusion ($11.4M in 2019) then you’re in the clear. If their estate is above the exclusion amount, your inheritance may be reduced by the amount of estate tax owed; however, the tax won’t be paid out of your pocket.

The second possible tax is charged at the state-level. There are six states that still charge inheritance taxes on the person receiving the inheritance. Check the rules for the state in which your family member lived and owned property.

Lastly, some assets have capital gain tax or ordinary income tax implications. For example, if you inherit shares of a stock you will owe capital gain tax if you sell the stocks at a gain. If you inherit an IRA you will owe ordinary income tax on the Required Minimum Distributions and other withdrawals.

Taxes can get confusing. Consult with a tax professional if you’re still not sure whether you will owe Uncle Sam.

3. I own my own business. Can I hire my teenage children to work for me?

To Your Wealth - March 19, 2019

Yes. Hiring your teenage children can prove to be a useful tax strategy if you play your cards right. Your child won’t owe taxes on earned income up to the standard deduction ($12,000 for single filers in 2019). Depending on how your business is structured, there may be additional deductions and tax strategies in your favor.

Be careful. The IRS requires business owners to provide reasonable compensation to working children for meaningful and helpful work related to the business. Chores like mowing the lawn or doing the dishes do not count. Treat them just like any other employee: fill out the necessary paperwork, leave a paper trail, keep track of their hours, and follow labor laws.

4. My spouse & I are thinking about buying a vacation home and are curious about any tax impacts we might experience (due to TJCA Tax Reform) if we finance the purchase.

To Your Wealth - March 26, 2019

If you itemize your deductions on Schedule A of your federal tax return, the mortgage interest paid on the loan will reduce your taxable income. With the passage of the Tax Cuts and Jobs Act effective in 2018, you can deduct your interest expense for qualified home purchases on combined loan amounts up to $750,000 (down from the prior limit of $1,000,000); and $375,000 for married filing separately (down from $500,000). These limits apply only to loans originated after 2017. If this a determining factor in your vacation home purchase, you should discuss this further with your financial advisor or tax preparer to better understand the true impact to your situation.

5. We want to save for our children’s college education. Is there a way to jump start our savings this year with a larger contribution to their 529 accounts without incurring a gift tax?

To Your Wealth - April 2, 2019

Yes! In 2019, the annual gift tax exclusion amount is $15,000 per person ($30,000 if a gift is made from married couples). If you prefer to make a larger contribution to your children’s 529 accounts without being subject to gift tax, you can make up to 5-years’ worth of the exclusion amount to each of their accounts (5 x $15,000 = $75,000; or $150,000 for married couples).

- Contributions at this level are prorated over a five-year period, therefore no additional gifts can be made to the child or the 529 account over the next four years if you want to avoid filing a gift tax return.

If an amount greater than $15,000, but less than $75,000, is gifted to the plan in a given year, additional contributions can be made each subsequent year without incurring gift taxes, up to the prorated level of $15,000 per year. (Or double this amount for married contributors.)

Keep in mind that the maximum allowable contribution amount to 529 plans are set by each state and range between $200,000 and $500,000+ per beneficiary. It’s important to know the limits of your child’s 529 plan.

6. I purchased a $5 million life insurance policy 5 years ago to provide for my family if I pass prematurely. Will the death benefit negatively impact my family’s inheritance due to a higher estate tax liability?

If you’re the owner of the policy, the policy proceeds will be included in your estate and subject to estate taxes when you pass. This year, federal estate taxes are not owed until the value of an estate exceeds $11.4 million. Adding $5 million to the value of your other assets could tip you over the tax-exempt threshold. If it doesn’t, then no federal estate tax would be owed on your estate when transferred to the next generation (under today’s federal estate tax law). Keep in mind that bequests to spouse are not subject to estate taxes, no matter how much is passed on to him/her.

Changing ownership of the policy to another trusted individual or irrevocable trust can help avoid this. Before taking action, however, it’s important that you consult with your trusted advisors to understand the requirements that must be met to make this change effective.

8. Can I continue to contribute to my Health Savings Account after I retire?

To Your Wealth - April 23, 2019

The short answer is “yes”, as long as you’re enrolled in an HSA-qualified high deductible health plan and haven’t signed up for Medicare. Be careful:

- Even enrolling in Medicare Part A automatically disqualifies your HSA contributions.

- If you contribute while ineligible, your contributions need to be corrected. Excess contributions need to be retracted in the same calendar year to avoid penalty. Any earnings on the contribution must also be removed, with the income portion reported as “other income” on your tax return. Failure to withdraw the excess amount prior to year-end will subject you to a 6% excise tax each year that the funds remain in the HSA.

- Even if you can no longer contribute to the HSA, funds in the account remain available for your use, and can even be passed on to your beneficiary(ies).

Check out our article on Medicare and HSAs for more information.

9. I have $200,000 of company stock in my 401(k) with a cost basis of $25,000. Someone mentioned that I can roll it out of the account under the NUA Rule. What is the NUA Rule and how does it work?

To Your Wealth - April 30, 2019

NUA stands for “net unrealized appreciation.” This is the difference in value between the stock’s purchase price (cost basis) and today’s price. Under this Rule, company stock can be distributed out of your employer’s retirement account with favorable tax treatment: the distribution is not subject to tax until the shares are sold and the distribution is not subject to the early withdrawal penalty.

When the stock is sold outside of the retirement account, the basis is taxed at ordinary income tax rates, the NUA is taxed at the capital gain rate, and net investment income is not subject to the 3.8% Medicare surtax. 100% of a typical distribution from a retirement account would be subject to ordinary income taxes (and potentially the Medicare surtax).

- A $200,000 distribution from your retirement account, taxed at ordinary tax rate of 37% results in a $74,000 tax bill (37% is currently the highest tax rate)

- If the $200,000 of company stock was distributed and sold under the NUA Rule, the tax bill would be $44,250 ($25,000 taxed at 37%, plus $175,000 at 20%/capital gain tax rate)

When rolling company stock out of your retirement account, 100% of the account must be rolled. The stock will be distributed in certificate form and the balance must be rolled to an IRA or another employer retirement account (if allowed). (Be careful! If the company stock is rolled into an IRA, the NUA rule no longer applies.)

10. I’m getting ready to sell my house. Where can I get the most “bang for my buck” when making upgrades?

To Your Wealth - May 7, 2019

According to Hanley Wood’s Housing Continuum Study, over 70 percent of homebuyers plan to remodel. While kitchen and bathroom renovations are common, you may have better results spending your money elsewhere. Go back to the basics and give the bones of the house an upgrade. Start with energy efficiency; replace attic insulation, install a new HVAC and water heater, or replace old windows. If you have the budget and time, replace the siding on your house. According to Remodeling Magazine, you’re likely to recoup 92.8 percent of the cost of adding new siding.

First impressions are not to be overlooked. Another area to focus your dollars on is the front yard. Consider putting a fresh coat of paint on your front door, pulling weeds, and adding new flowers and mulch. Studies have shown that you make back 91% of your investment when replacing your front door.

11. I’m purchasing my first home and am unsure what replacement cost option I should choose for my homeowners insurance. What are my choices?

To Your Wealth - May 14, 2019

Guaranteed replacement: This option covers 100-percent of the cost to repair or rebuild your home, with no limit. This type of coverage is the most expensive, but it’s the recommended type of coverage if you would want to rebuild your home exactly as it is today. (An endorsement to the base policy would be required for guaranteed replacement.)

Replacement cost: With this option the maximum amount the insurance company would pay is the amount stated in your policy. This type of coverage is less expensive and, not surprisingly, the most common. Determining the replacement value of your home each year is imperative to ensure the insurance amount paid doesn’t “fall short” of the actual cost.

Actual cash value: This option pays for replacement of the home, reduced by depreciation or wear on the property. This type of coverage is not typically recommended, but may be appropriate under particular circumstances.

13. What’s an appropriate amount of money to spend on a wedding gift?

To Your Wealth - June 4, 2019

Being a wedding guest can be harsh on your budget, especially if you’re in the stage of life where it feels like you have a wedding to attend every other weekend. When it comes to gifting, it can be difficult to determine how much to spend and what to spend it on. To put it plain and simple: there is no minimum gift amount. You may have heard that the general rule of thumb is to “buy your plate” however; it may make more sense to base your gift on a) what you can afford at the time and b) your relationship to the couple.

Once you’ve nailed down how much you’re willing to spend, you’re left with picking out the gift. More often than not, the couple has put together a registry of items they would like. Get to the registry early so you have more options that fit your price range. Increasingly, couples have been requesting contributions toward their honeymoon in lieu of physical gifts like you’d see on a registry. Cash or check is always an option too. Remember that in the end, it’s not about the gifts so don’t bust your budget over it. Happy wedding season!

14. I use budgeting apps but still can’t seem to stick to my budget. Where do I go from here?

To Your Wealth - June 11, 2019

Budgeting apps are great, but if you don’t check your Mint account as often as your Instagram or inbox, is it really worth it? Just like reusable grocery bags stowed away in your trunk, the phrase “out of sight, out of mind” rings true. If you find that budgeting apps aren’t keeping you in check, try envelope budgeting.

Envelope budgeting is when you begin the month entirely in cash. Each budget category is stored in a separate envelope. Once you spend down the cash for the month you can’t spend in that category until the next month arrives. Many people find that paying in cash is more difficult than swiping a card, thus making one question whether they really need that new pair of tennis shoes. If you struggle in just one of two areas of your budget, try envelope budgeting for just those expenses.

15. I just inherited money. What should I do with it?

To Your Wealth - June 18, 2019

Inheritances can come in all shapes and sizes. Someone wanted you to receive the money and it’s best that you act as a responsible steward. It may be tempting to indulge yourself in a vacation, splurge on an expensive item, or possibly increase your standard of living. Before you do so, make sure you’ve covered all of your bases. Here are our suggestions as to your potential checklist items before making any decisions.

Follow in this order:

- Establish an emergency fund of 3-6 months of your living expense

- Pay down high-interest debt such as credit cards or student loans

- Invest!

- For tax-efficient investing, consider increasing your 401(k) or 403(b) deferrals and making deductible IRA contributions if applicable.

- For tax diversification, consider investing money in a brokerage account. Once investments are sold, they are taxed at capital gains rates instead of as ordinary income.

7. When should I use my debit card and when should I use my credit card?

When it’s time to checkout you may be faced with the decision: debit or credit? Credit and debit cards each have their place and there are certainly situations when one is better than the other.

Opt for your credit card when making online purchase because they typically offer greater protection against fraudulent activities. Credit is also preferable when traveling abroad because credit cards typically often have fewer foreign transaction fees. Reach for your debit card if you’re operating on a tight budget. The spending limit is your checking account balance, unlike the credit limit on a credit card. If you’re in need of cash, your best bet is using your debit card at a free ATM since nearly all credit cards charge a much higher rate for cash withdrawals, even up to 24%!

17. I’d like to begin introducing my elementary-age children to financial concepts. Where should I begin?

It’s great that you’re eager to begin teaching your children about finances! During the elementary school years, there are several ways you can introduce your children to basic financial concepts.

- Give them an allowance: Paying your children for completing assigned chores around the house can be a good way for them to begin earning their own money.

- Open a bank account: Teach your kids the importance of saving by opening a checking or savings account for them (one that earns interest is advisable). We suggest having them save a portion of their allowance or cash gifts received. And in time, they’ll enjoy watching their account balance grow.

- Responsible spending: It’s important to provide some guidance as to how your young child spends his/her own money; however, allowing them to make the final decision will help them understand the outcome from good versus bad spending…and how they feel in both circumstances.

- Share the wealth: Begin talking with your children about giving to others. Most children enjoy picking out gifts for family members or friends. They may also have a special interest that they didn’t know they could support via a small donation (for example, giving to an animal shelter if they love animals). Having them set aside a portion of their earnings for gifts to others or for a special cause can help them develop a lifelong attitude of sharing.

20. I’m going to Europe soon. What happens if I get injured there?

To Your Wealth - July 23, 2019

You can plan your itinerary down to the minute but you can’t predict accidents and injuries. Don’t wait until an accident happens to form a plan. Most health insurance plans do not provide coverage outside of the States and Medicare only covers a few rare circumstances. If you’ve got an international trip coming up you’ll want to purchase travel insurance. Travel insurance typically covers emergency medical and dental expenses incurred while abroad. Some situations are excluded from coverage so read the fine print before purchasing. Travel insurance works on a reimbursement basis, meaning you’ll have to front the money to pay the bills and insurance will send you a check when it’s all said and done.

21. My child is 18 and heading off to college in the fall. Are there legal documents I/we should consider prior to leaving the nest?

To Your Wealth - July 30, 2019

While the need for a trust or will for your child is likely unnecessary, credence should be given to the creation of medically based documents in the case something unforeseen should happen. Even as their parent, once your child reaches age 18 and becomes a legal adult, your ability to obtain medical information or make medically-based decisions on your child’s behalf is null due to HIPAA restrictions.

To ensure you have the ability to obtain information in case of an emergency or to have the ability to make decisions due to an incapacitation, you and your child should give consideration to the following documents:

- Medical Power of Attorney or Health Care Proxy

- This allows for your child to appoint an ‘Agent’ to act on their behalf as it relates to medically based situations. It should also include a HIPAA authorization form but this can also be created to stand alone.

- Durable Power of Attorney

- This document is broader in its powers and allows for the acting ‘Agent’ to obtain financial documents, enter into legal contracts, and sign leases. These powers exist whether a medical situation is present or not so authorization in this manner should only be given to a trusted individual.

To ensure these documents are structured accurately and according to law, it’s important to convey your wishes and expectations with an attorney as to avoid any pushback in the case a medical emergency should arise.

23. I’ve heard of the Backdoor Roth IRA strategy, however, I recently came across the term Mega Backdoor Roth IRA. How does this strategy work?

To Your Wealth - August 13, 2019

The Mega Roth IRA is similar in nature to the Backdoor Roth IRA strategy but takes it a step further through an employer sponsored 401k. To capitalize on this strategy, your employer plan MUST allow after-tax contributions and in-service distributions [or non-hardship withdrawals] in conjunction with the normal salary deferral and subsequent match. [*It’s important to note that After-Tax does not mean Roth 401k contributions.]

To implement the strategy, ensure you are set to max out your 401k *[$19,000 for 2019] and determine the amount your employer will be matching on your behalf. The IRS limits total annual contributions to a 401k *[$56,000 in 2019] so you will want to make after-tax contributions for the difference [$56,000 limit - $19,000 deferrals - employer match]. As soon as feasibly possible [to avoid taxes due on any growth], rollover the after-tax contributions to your Roth IRA and be sure to keep accurate records.

*Aforementioned limits are increased for individuals 50+

25. What are the contribution limits for various retirement accounts in 2019?

To Your Wealth - August 27, 2019

The most common plans have the following limits:

Less common retirement plans for business owners include SEP IRAs and solo 401(k)s. For a SEP IRA, you can contribute as much as 25% of your compensation, up to a $56,000 limit.

Solo 401(k)s are a little more complicated as they include two types of potential contributions – employee and employer. The employee contribution has the same limits as a regular 401(k) - $19,000 and $25,000 depending on one’s age. The potential employer contribution is calculated differently depending on the structure of the company. The combined employee and employer contributions are limited to $56,000 ($62,000 for those over 50).

27. Life Insurance: When do I need it?

To Your Wealth - September 10, 2019

You should actually look at this decision two different ways. When do I NEED life insurance and when should I BUY life insurance. There is no magic age that one should purchase life insurance. Instead, this decision is heavily influenced by who would be impacted financially if you pass away. The argument can be made that an individual without a partner or children doesn’t need to prioritize life insurance. However, when you are at the point you want to provide financial security for someone else upon your passing, you need to review your life insurance options. Many employers offer life insurance coverage as a benefit so you may have a policy in place already, but the coverage amount may not be adequate enough to meet your goals.

If you anticipate needing life insurance in the future, it may be beneficial to purchase a policy before you actually need it. The younger and healthier you are, the less expensive your insurance premiums will be. For example, if you envision starting a family in the next few years, you may want to go ahead and purchase a policy now in an effort to reduce your premiums. You could also run into a situation where you may get a health diagnosis that significantly increases your premiums or causes you to be uninsurable all together. The sooner you can evaluate your options, the better.

28. Life Insurance: How Much Do I Need?

To Your Wealth - September 17, 2019

Similar to the decision on when to purchase life insurance, there is no one size fits all approach to the amount of life insurance one should carry. The amount will be unique to each individual’s financial goals and circumstances. Think about who relies on you for financial support. What type of financial security would you want to provide if you pass away? Think about the factors below when calculating your need.

- Outstanding mortgage balance

- Other outstanding debt balances

- Future college education costs (education inflation is between 6-8%)

- Annual living expenses of surviving family members

- Retirement income need for spouse

- Funeral expenses (between $8,000-$20,000)

- Other underfunded savings goals, unique to your situation

Don’t forget about individuals who may not be earning a paycheck. In the event that a stay at home parent passes away, the surviving parent may need to pay for things like a nanny or after school care. Those costs are not insignificant and will add up quickly.

You may have life insurance through your employer, but that is typically not enough to meet your financial goals. In the event you change employers, your new employer may not offer the same level of coverage. When purchasing your own policy, consider whether you want all of your coverage to be personally owned or if you feel comfortable enough to rely on your current and future employers for a portion of your coverage.

29. Life Insurance: What type do I need?

To Your Wealth - September 24, 2019

Term Life Insurance: The most simple and straightforward type of life insurance there is. You pay an annual premium for a specific period of time, such as 10, 20, or 30 years. Once the term lapses, your life insurance coverage ends. You do not recoup any premiums for outliving the policy and there is no cash value that accumulates. Some people ladder multiple term insurance coverages to terminate as their family insurance needs decrease (children are through college, mortgage paid off, sufficient assets accumulated, etc.). These polices are most suitable for individuals looking for a low cost option that provides a death benefit, but no additional benefits.

Whole Life Insurance: Whole life insurance has a death benefit like term insurance, but also has a cash value that accumulates as you pay your premiums. Initially the majority of the premiums cover fees and maintaining the death benefit. Over time, more of the premium is allocated to the cash value. That cash value can be borrowed, used to pay premiums, or even withdrawn in the future. The cash value component does not come without a cost. Whole life policies are significantly more expensive than term life policies. If you decide to surrender the whole life policy, you will need to determine if there are any surrender fees or tax implications to surrendering the policy. Whole life is sometimes sold as an investment vehicle combined with insurance protection. This type of coverage should be considered when the need for coverage is permanent, your estate plan requires insurance to provide liquidity, or there is concern for future insurability.

Universal Life Insurance: Universal life insurance has accumulates a cash value as well, but also allows the owner to make changes to the premiums or death benefit. The growth of the cash value is tied to the performance of the underlying investments. Similar to whole life, universal life insurance provides coverage for life, but generally has a lower premium payment than a whole life policy.

Consider the purpose you are purchasing life insurance. If the goal is to provide financial support for loved ones, start by looking at term insurance. If you want additional benefits like cash value or the opportunity to adjust premium payments and are willing to pay for those benefits, explore universal or whole life coverage.

31. Our first grandchild just arrived and we’d like to open a 529 college savings account for him. How do I know what plan is best, and does he have to go to college in the state of the 529 account we choose?

To Your Wealth - October 8, 2019

There are websites where you can find rankings on the best 529 college savings plans with regard to fees and investment options; however, that’s not all that’s important to consider. Some states offer tax incentives for residents who participate in their plan. Indiana, for instance, gives residents who contribute to the Indiana CollegeChoice 529 College Savings plan a state tax credit equal to 20% of the amount of their contribution, up to a maximum credit of $1,000. This credit comes right off your tax liability – that’s a 20% growth rate right out of the gate! (20% of $5,000 is $1,000 maximum credit) Most plans now offer competitive, low costs along with good investment options. So, I suggest you first look into the tax incentives that your state may provide. If it does offer incentives, then make sure that the underlying investment options and fees are also reasonable…comparing the state tax incentive with the rest of the plan options.

The beneficiary of a 529 account does not have to go to school within the state of the plan. Your grandson could choose to go to college at any accredited university of his choosing (even abroad) while receiving all of the tax benefits that come from using a 529 college savings account.

To compare all state 529 college savings plans, checkout the website www.savingforcollege.com.

Back to the Top | Submit a Question | Bedel Blog

32. I know a little bit about the HIPAA law and recently heard that I won’t have access to my children’s health care providers/records after they turn 18. Is this true?

To Your Wealth - October 15, 2019

Yes, HIPAA (Health Insurance Portability and Accountability Act) was in-acted in 1996 to protect patients’ rights concerning their medical information. As a parent, you have the ability to talk with your children’s doctor about an illness or injury and even prescriptions that they’re on; but all of that goes away once they attain the age of adulthood, 18. Many people don’t realize that when they send their children off to college, that they’ll no longer be privy to any issues they might be dealing with health-wise unless the child can contact them or give their doctor permission to share information. If a child is incapacitated, it is likely parents won’t know that their child is under the care of a physician until he/she is able to give medical providers the okay to contact you. What can you do? Whether your young adult child has gone off to college, is no longer living with you, or is still at home, it’s important to have him/her execute a Health Care Power of Attorney document with a HIPAA waiver. This document gives your child the ability to appoint someone to make health care decisions on his/her behalf, as well as indicate with whom the medical professionals can share information regarding medical issues. And, if you haven’t yet executed this document for yourself, it’s vital that you do so as well!

33. What is disability insurance? Do I need it?

To Your Wealth - October 22, 2019

Disability insurance protects your income in the event of disability. For example: you are involved in a car accident that results in a serious injury. You are unable to work for the next 6 months. If you are covered by disability insurance, your policy would pay benefits to you during this time in order to replace lost income from being unable to work.

According to the Social Security Administration, 30% of workers entering the workforce today will become disabled for a period of three months or longer during their career. The average long-term disability is 2.5 years (Council for Disability Awareness).

Many are under the impression Social Security Disability Insurance (SSDI) will pay in the event of disability. However, an average of 63% of initial SSDI application claims were denied from year 2007-2016 (Social Security Administration). For those who did receive SSDI benefits, the average monthly benefit with $1,472 for men and $1,168 for women.

If you became disabled today, could your family continue to make ends meet if your current income is lost? If the answer is no, then obtaining disability insurance should be at the top of your to-do list.

34. What type of disability insurance do I need? And how much?

To Your Wealth - October 29, 2019

There are two general types of disability insurance policies: short-term and long-term. Short-term disability insurance typically begins paying benefits within a few weeks of disability. These policies will continue paying benefits up to a specified benefit period (example: typically 60 – 90 days). Long-term disability insurance begins paying benefits after a few months of disability, anywhere from 2 months to 3 years. These policies continue paying benefits for a much longer specified benefit period (example: some policies can pay up to age 65+).

Do you need short-term disability coverage? If your cash on hand would last you less than 90 days, consider obtaining short-term disability coverage. Short-term disability can cover injury (broken leg), surgery recovery (knee replacement), or the birth of a baby. Yes, short-term disability insurance can cover maternity leave in some instances!

While short-term coverage is important, long-term disability insurance pays benefits for a longer period of time. If you become permanently disabled, would you be able to cover living expenses with savings? For most people, the answer is no. That’s why long-term disability insurance is important.

Coverage amounts range and depend on your specific policy. Typically you can replace 60% to 70% of income. High-earners beware! Many policies cap monthly benefit amounts; for example, a policy may pay 60% of income up to a monthly maximum of $5,000. Having a clear understanding of what the policy constitutes as income is important. For example, does the policy cover salary only, or does it include bonuses and/or commissions?

To summarize: If you don’t have enough cash on hand to keep you afloat for a few months, consider purchasing short-term coverage. If you’re in the early or middle stages of your career, consider purchasing a long-term disability policy to protect your future earning power. Since you will be hard-pressed to find a policy that replaces 100% of your income, shoot for a policy that will cover 60-70% of income.

Check out our Insurance Gaps infographic to learn more.

35. What else do I need to consider when obtaining a disability insurance coverage?

To Your Wealth - November 5, 2019

Disability definition, benefit taxation, guaranteed and non-cancelable provisions and policy portability are four important aspects to understand when applying for and purchasing disability coverage. Benefit period and elimination period are two important considerations, as well. We touched on these topics in last weeks column.

Disability policies have different definitions of disability. There are two main types: own-occupation and any-occupation. An own-occupation policy pays benefits if you cannot perform the duties of your specific job. In contrast, any-occupation policies pay benefits if you cannot perform duties of any job. Since own-occupation policies contain a broader definition of disability, policies with this definition are more desirable.

Another important consideration is taxation of benefits. If your employer pays the premiums of your disability policy, benefits received in the event of disability will be taxable. If you pay premiums with pre-tax income, benefits will also be taxable. However, if you pay policy premiums with post-tax dollars, benefits received are tax-free.

Want to ensure your policy premiums won’t be increased? Make sure your policy is non-cancelable. Want to make sure the insurance company cannot cancel your coverage, as long as you continue to pay premiums? Make sure your policy is both non-cancelable and guaranteed renewable.

Lastly, understand the portability of your disability coverage. Let’s say your disability coverage is solely a group policy provided by your employer. If you ever leave the company, you will no longer have this coverage. The only way to make sure your disability coverage travels from employer to employer is to purchase an individually-owned policy. While group coverage can be more cost effective and subsidized by employer paid premiums, you run the risk of forfeiting coverage if you ever leave.

36. I’m planning to give my son a puppy for his 10th birthday. Should I buy pet insurance for it?

To Your Wealth - November 12, 2019

- It depends. Pet insurance is a great way to make sure you can afford extensive care for your puppy if he becomes severely injured or ill; but before you buy, first consider how much you can spend on his care without jeopardizing your own financial well-being. If you feel that a $5,000 vet bill would put damper on your budget, consider buying insurance to help pay for the cost. First determine the maximum amount you could safely spend on your puppy’s care; then determine how much insurance is needed to cover the difference, if any.

- Pet insurance is similar to health insurance for individuals. There are different policy-types and each will differ based on the benefits provided. Of course, the more extensive the coverage, the higher the premium. The price also varies according to the breed, age and existing health of a pet. The monthly premium could range between $10 and $100+, depending on these factors.

- If you do decide to buy insurance for your new puppy, it’s a good idea to buy it sooner, rather than later to avoid exclusions for any pre-existing conditions he might encounter after arriving in his new home. Good luck and enjoy!

37. Can I name a trust beneficiary of my IRA, rather than my children individually?

To Your Wealth - November 18, 2019

Yes you can. However, make sure that the trust includes language that gives the trustee the capability to leave the IRA monies in an IRA (and that it can be divided among the trust beneficiaries, so they each have their own inherited IRA).

Leaving the IRA intact after you’re gone allows the beneficiaries to continue the tax-deferred growth of the investments within the IRA, rather than it being cashed out with the net, after-tax proceeds disbursed among the trust beneficiary(ies). Cashing out the IRA would also generate a lot of taxable income (which is taxed at federal, state and local ordinary income tax rates), thus leaving a smaller, after-tax amount to your children. Income taxes at the estate and trust level get to the highest rate with just $12,750 of realized income (37% tax rate).

Keeping the IRA in trust allows the trustee to manage withdrawals from the IRA based on the provisions outlined in the trust document. Should the trust terminate/cease to exist, the IRA would then become an Inherited IRA of the beneficiary…still within the tax-deferred IRA wrapper.

38. What is Small Business Saturday all about?

To Your Wealth - November 26, 2019

Small Business Saturday was created by American Express in 2010 to bring more customers to small businesses. It’s actually now a National Holiday and is highly promoted across the US. Why? Small businesses create higher paying jobs in your city, plus they create jobs for essential professions, such as police officers, teachers and firemen. They also donate to local not-for-profits and common causes in the community (250% more than larger businesses). (Seattle Good Business Network) And, when you spend $100 at a local business, $68 of that stays within the community (versus $34 from national chains). (NFIB)

Not only do local businesses and communities benefit from this holiday, so do consumers. Participating stores offer enticing discounts and oftentimes serve snacks and beverages to their customers while they shop. (Google your local shopping areas for general information and check your favorite stores to find out if they’re offering discounts.) In 2018, there were 104 million shoppers on this holiday and they spent $17.8 billion. Hopefully you can get out there this Saturday and help grow the participation! I plan to! Read More: Sometimes Small is Better: Shop Small Business Saturday!

39. I know I need an emergency fund and I’ve always heard it should contain 3-6 months of living expenses. So, should I shoot for three months or six?

As you’ve pointed out, the general consensus is to hold anywhere between three and six months of living expenses but that can mean a difference in thousands of dollars depending on your expenses.

Consider the following questions when determining how much cash to hold:

- Do you rent?

If so, your housing costs are fixed. For example, you’re probably not on the hook when the washing machine breaks. Renters can lean more toward the three month mark. If you own your house, your costs can vary month-to-month depending on what needs fixed. It’s a safe bet to carry five or six months of living expenses. - Do you have dependents?

If so, you’d fall on the higher end of the emergency fund spectrum because other people are counting on your income. - Is your income steady?

If you’re a W-2 employee then you know how much to expect every pay period. However, if you’re an independent contractor or small business owner, your income may vary. Shoot for six months of living expenses if your income fluctuates.

Remember that emergency funds are supposed to cover necessary living expenses. Expenditures such as dining out or maintaining your Hulu membership aren’t as important as groceries and the mortgage payment.

40. What end-of-year tax planning should I be doing?

To Your Wealth - December 17, 2019

Depending on your life stage and cash flow, there are a few strategies you can deploy to reduce your tax bill. For starters, Indiana residents are eligible for a 20% state tax credit on contributions made to Indiana 529s. The 20% credit is limited to contributions up to $5,000 meaning the maximum credit is $1,000. 529 contributions are due on December 31.

Another way to save is through charitable giving. If you’re on the brink of itemizing your deductions, consider opening a charitable gift account and funding it with 2-3 years’ worth of charitable donations. This tax strategy is known as charitable lumping (link). If you’re over the age of 70.5 you have the ability to make income tax-free qualified charitable distributions (QCDs) from your IRA. This is an excellent strategy for taxpayer’s whose required minimum distribution (RMD) is greater than their living expenses, or for charitably minded folks that aren’t itemizing. The maximum annual QCD is $100,000 per filer and charitable donations must be made by December 31st.

Finally, qualifying taxpayers can make a deductible IRA contribution. In order to make a deductible IRA contribution your modified adjusted gross income (MAGI) must fall be below the phaseouts (link). Don’t know your MAGI just yet? No worries. 2019 IRA contributions are not due until April 15, 2020.

41. How will the impeachment proceedings against President Trump affect the market and my investments?

To Your Wealth - December 24, 2019

While the impeachment of a president is a rare event, past experience indicates that the stock market should not be directly affected in any meaningful way from the act of impeachment itself. During the 1998 impeachment proceedings against President Bill Clinton’s, the S&P 500 increased close to 27% between the date the impeachment inquiry began and when he was formally acquitted by the Senate. Similarly, throughout the past several months the stock market has largely ignored any of the impeachment-related news, instead being driven more so by economic data and corporate earnings. Our long-term approach to investing helps us to focus on the big picture when evaluating the impact of the health of the economy and markets on your portfolio and to not get distracted by the 24-hour news cycle.

16. I just applied for Social Security benefits – when can I expect my first check?

Social Security benefits are paid in arrears, thus, your first deposit will arrive the month after your requested application date. (If you signed up for benefits to start in April, your first deposit will arrive in May.)

Social Security benefits are always paid on Wednesday; however, what Wednesday of the month depends on your birth date.

- If your birthday falls between the 1st through the 10th of the month, you can expect your deposit on the 2nd Wednesday of each month.

- If your birthday falls between the 11th and 20th, your deposit will arrive the 3rd Wednesday.

- And if you were born after the 20th of the month, your deposit will arrive on the 4th Wednesday

There are a few variances from the above rule:

- If you receive both Social Security and SSI payments, your deposit will arrive on the 3rd day of each month, and

- If your deposit is to arrive on a holiday, you can expect it a day early.

Social Security checks are no longer mailed via the USPS. Your benefit can be received by direct deposit to your bank account or via auto deposit to your Direct Express® Debit MasterCard® account (a prepaid debit card).

Here is the full Social Security benefit calendar for 2019.

12. How do I know when it makes sense to refinance my mortgage?

Refinancing can be a great idea if the interest rate on your refinanced loan is at least one percent less than your current interest rate. All other things equal, the lower the interest rate means a lower monthly payment.Another way to justify a mortgage refi is by looking at the break-even point. Similar to when you first took out a mortgage, there are closing costs associated with refinancing. To calculate your break-even point, divide your closing costs by the difference in your monthly mortgage payments under the refi. For example, if the closing costs are $2,000 and the monthly payment decreases by $100 per month, the break-even point is 20 months. If you plan on selling the home before the break-even point, then refinancing doesn’t make sense.

You should also consider the timing of the refi. You build equity in your home when you pay down the principal. However, during the first years of your mortgage, most of the monthly payment goes toward interest. Let’s say you’re 12 years into a 30 year loan when you decide to refinance into another 30 year loan. This means you’re going back to paying mostly interest, and once it’s all said and done you’ll have made 42 years worth of mortgage payments!

Back to the Top | Submit a Question | More Mortgage Articles

18. My parents are in their 80s and I worry about them falling victim to a scam or fraud. Is there anything I can do to prevent this from happening?

Unfortunately, your parents belong to a vulnerable group whose age and money are constantly being exploited. While there isn’t much you can do to prevent the fraudsters from pursuing them, you can help your parents prepare their defense. Consider employing some of the strategies below:

- Educate your parents on examples of common fraud techniques including email scams, phone messages, and mailings.

- Teach them quick responses to unwanted solicitors such as “I never buy from someone who shows up unannounced. Send me something in writing.”

- Encourage your parents to let unknown calls go to voicemail. If the call is important, the caller will leave a message.

- Replace their landline with a cell phone, unlist their numbers from public directories, and/or sign up for opt-out and Do Not Call lists.

- Shred all unnecessary documents that contain account numbers, Social Security numbers, or Medicare numbers. This also includes empty medication containers, such as pill bottles from the pharmacy.

- Americans are entitled to one free credit report every twelve months from each of the three credit reporting agencies. Tell your parents to pull a report every four months to make sure nothing looks awry.

19. My 401(k) offers a Roth option. Should I contribute to it?

Deciding whether to contribute to a Roth 401(k) or Traditional 401(k) is always a tax question. First you must understand the difference: Traditional 401(k) money goes in tax-deferred and is taxed when withdrawn whereas Roth 401(k) money goes in after-tax and comes out tax-free in retirement. Consider going the traditional route if deferring your income drops you into a lower tax bracket or makes you eligible for certain tax benefits such as the Child Tax Credit. Otherwise, the Roth 401(k) is a great place to park your money. If you’re phased out of making Roth IRA contributions, consider directing money to your Roth 401(k) since there is no phase-out. Another reason to contribute to your Roth 401(k) is that once you leave the job you can roll the Roth money into a Roth IRA. Doing so will avoid required minimum distributions levied on 401(k)s and Traditional IRAs.

Back to the Top | Submit a Question | More Roth IRA Articles

22. Should I list my children [ages 8 & 6] as beneficiaries to my retirement accounts?

If your intent is for your retirement accounts to pass to your children…then absolutely! However, there are considerations to be given prior to completing your beneficiary forms.

If your children are listed as stand-alone beneficiaries and you were to pass, you want to ensure that you have named a custodian to oversee the account; otherwise, the courts will assign one for you which can be time-consuming and costly. The drawback is that, upon the attainment of age of majority [18 or 21 depending on the state], the custodian is dropped and the child now has full access to the account. They could liquidate the account in full and buy their dream sports car…and likely incur a large tax bill!

A way to control the flow of inherited assets would be through the establishment of a trust. The trust would then be named as the beneficiary to the IRA, and your children the beneficiary of the trust. The trust allows you to control when and how much can be distributed to your children as well as what the assets can be distributed for. If your intent is for a portion of their inheritance to pay for college expenses or a wedding, those provisions can be set forth in the trust document and carried out by the trustee.

26. What is a wash sale?

A wash sale refers to an IRS regulation that can disallow the realization of tax losses when selling a security. Specifically, a loss may be disallowed if an investor sells a security at a loss and buys back a “substantially identical” security within 30 days of the sale (either before or after). The repurchase of a substantially identical security includes any purchases made by a spouse or purchases made in a retirement account like an IRA or Roth IRA.

If a wash sale occurs, the disallowed loss is added to the cost basis of the newly purchased security. You therefore do not lose the benefit forever, it is merely postponed.

Note that the wash sale rule only applies to losses. If you sell a security at a gain and buy it back the next day, you still have to report the gain on your tax return.

30. Life Insurance: Should I buy life insurance for my child?

It depends. Because you are not dependent on your child financially, it’s not necessary. However, some people prefer to buy a small policy to make sure they have funds for an adequate funeral and burial should their child pass prematurely and cash flow is tight. If you have concern that your child may be uninsurable as he/she gets older, buying a policy when your child is young may make sense. In this case, a permanent policy would be ideal, but premiums could get expensive as your child gets older. You should also ask your insurance agent about including a rider on the policy that would allow your child to purchase additional insurance without medical underwriting (guaranteed insurability). Using life insurance as a savings tool for college, wedding, or otherwise is not recommended as there are other savings vehicles that are less costly and more tax efficient for these needs. If you’re considering buying a policy on your child, talk with your financial advisor first to ensure that it’s the best resource for your personal situation.

Back to the Top | Submit a Question | More Insurance Articles

Stay tuned for next week's question & don't forget to submit your question!

Prior to implementing any investment strategy referenced in this article, either directly or indirectly, please discuss with your investment advisor to determine its applicability. Any corresponding discussion with a Bedel Financial Consulting, Inc. associate pertaining to this article does not serve as personalized investment advice and should not be considered as such.